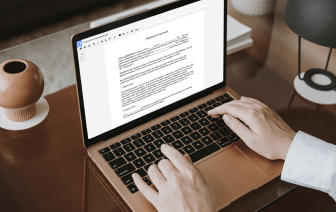

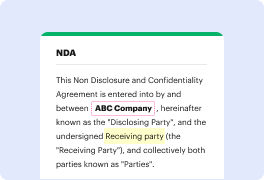

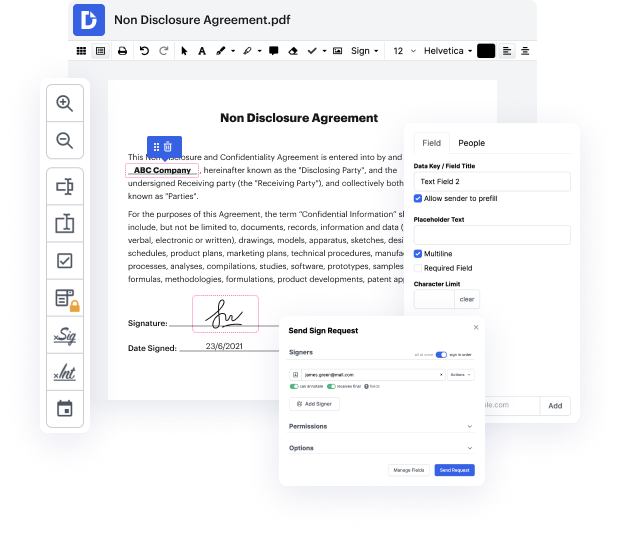

Time is an important resource that each organization treasures and attempts to turn in a advantage. When selecting document management software, take note of a clutterless and user-friendly interface that empowers customers. DocHub offers cutting-edge tools to optimize your document administration and transforms your PDF editing into a matter of a single click. Hide Brand Logo to the Home Loan Application with DocHub to save a lot of time and boost your efficiency.

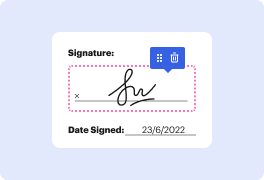

Make PDF editing an simple and easy intuitive operation that helps save you plenty of precious time. Effortlessly modify your files and deliver them for signing without the need of switching to third-party alternatives. Give attention to pertinent duties and improve your document administration with DocHub today.

have you attempted a loan modification for a bearish agreement short sale or some other homeowners retention program with your servicer trying to avoid the foreclosure in your home meanwhile your lender is telling you that because your application is in review all foreclosure action has been postponed or has your servicer told you that they do offer homeowners assistance programs to anyone facing foreclosure however your application have been denied because the investor that owns your loan do not participate with any foreclosure prevention programs how irritating welcome to next gen 2.0 lawn modification master class im david washington real estate broker and certified distressed property expert ive been in a real estate business for well over 25 years specializing in all types of complicated real estate matters including foreclosure prevention there are a variety of reasons why someone may be facing foreclosure in addition to sickness death of a loved one divorce or job loss some r