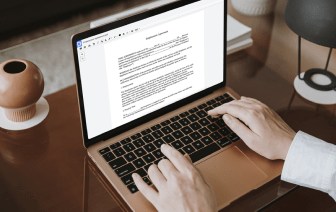

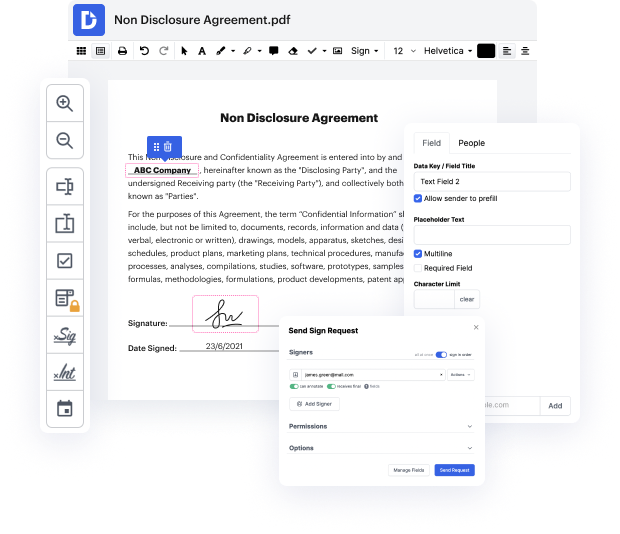

When you want to apply a small tweak to the document, it should not require much time to Go over payment attestation. Such a basic activity does not have to require extra education or running through guides to understand it. Using the proper document modifying resource, you will not spend more time than is needed for such a swift change. Use DocHub to streamline your modifying process whether you are an experienced user or if it is your first time making use of an online editor service. This tool will take minutes or so to figure out how to Go over payment attestation. The only thing required to get more effective with editing is actually a DocHub profile.

A plain document editor like DocHub will help you optimize the amount of time you need to dedicate to document modifying no matter your previous knowledge of this kind of instruments. Create an account now and improve your productivity immediately with DocHub!

[Music] ala Simon here aka the Spaniard Ive received a lot of emails recently from people that are receiving claims from various benefits agencies for alleged overpayments alright of whatever benefit were you know were talking about very simply if you have given misinformation or incorrect information to a benefits agency then quite clearly you are responsible all right put your hands up and make an arrangement however if the benefits agency staff have made a boo-boo and have overpaid you as a result of one of their mistakes or incorrect information that theyve given to you then the responsibility is theirs the liability is theirs and they shouldnt be chasing you up for him now I have put into practice a number of questioning techniques in order to assist our friendly benefit agency staff and to docHub the conclusion that some Ive just explained all right because you do have to help them out sometimes they just dont understand to do thing and let me just explain what happened ver