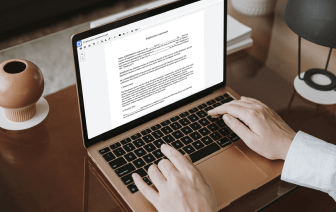

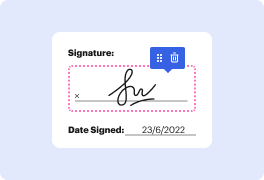

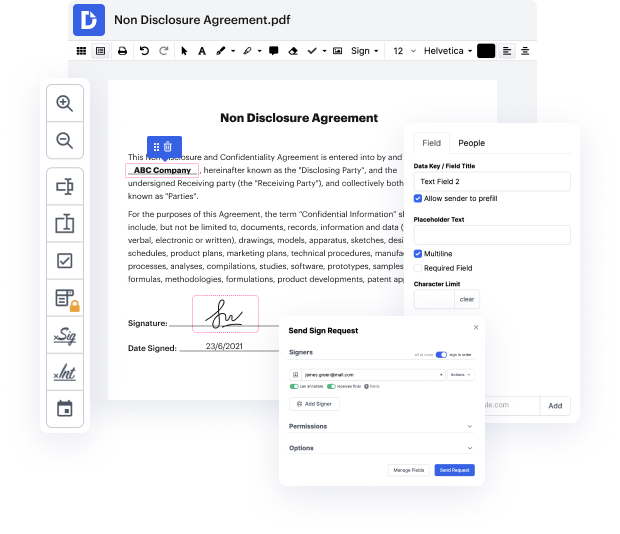

DocHub makes it quick and simple to fill in TIN in UOML. No need to download any extra application – simply upload your UOML to your account, use the simple drag-and-drop interface, and quickly make edits. You can even use your desktop or mobile device to adjust your document online from any place. That's not all; DocHub is more than just an editor. It's an all-in-one document management platform with form constructing, eSignature capabilities, and the ability to enable others fill out and sign documents.

Every file you edit you can find in your Documents folder. Create folders and organize records for easier search and retrieval. Additionally, DocHub guarantees the security of all its users' data by complying with strict protection standards.

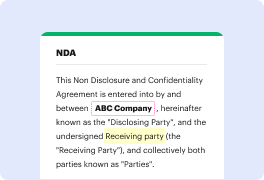

An Individual Taxpayer Identification Number, or ITIN for short, is for people who have a federal income tax filing or reporting requirement, but who are not eligible for a Social Security number. Taxpayers who need an ITIN can mail a completed form W-7, along with the required identification documents and federal tax return, to the IRS. Check out the instructions for Form W-7 for a list of acceptable identification documents. Only send original identification documents or a copy that was certified by the agency that issued it. Another option, rather than mailing original documents like your passport, is that you can work with a docHubing acceptance agent, known as a CAA, whos authorized by the IRS to verify your documents. You can also make an appointment to get help at selected IRS Taxpayer Assistance Centers. Remember that any ITIN that isnt used on a tax return at least once in three years will expire at the end of the third year. If it does, and you need to file a tax return, b