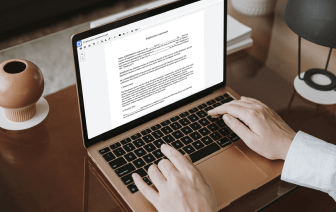

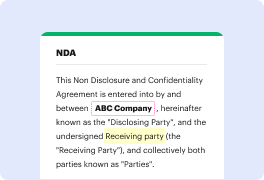

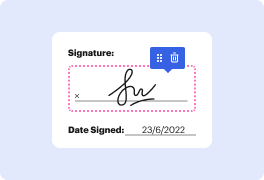

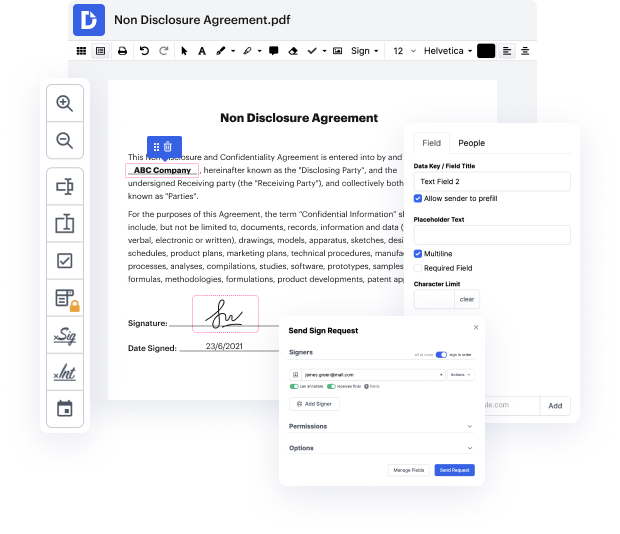

DocHub is an all-in-one PDF editor that allows you to fill in TIN in UOF, and much more. You can underline, blackout, or remove document components, add text and pictures where you need them, and collect information and signatures. And since it works on any web browser, you won’t need to update your hardware to access its robust features, saving you money. With DocHub, a web browser is all it takes to handle your UOF.

Sign in to our service and adhere to these guidelines:

It couldn't be easier! Enhance your document management now with DocHub!

you will get your TR in 24 hours so letamp;#39;s get started hi welcome back guys in this video Iamp;#39;ll be show you step by step on how to get how to register and receive your D in Nera in4 hours in this video I will show you how to get it done because some people are complaining I didnamp;#39;t get my ti Iamp;#39;ve done it three times like 3 months ago this this way Iamp;#39;ll be showing you today you will get your ti in 24 hours so letamp;#39;s get started my name is in this video I want you to follow me through step by step donamp;#39;t skip any part because I donamp;#39;t want you to come and be asking question that have been answered in the video so kindly follow me through to the end of the very video and see how you get it and receive the email that your your T is ready thank you so head up to your Chrome browser click on you can see T n. jb. goov go. see ttb.gov and say C you donamp;#39;t need c before you get this done before you