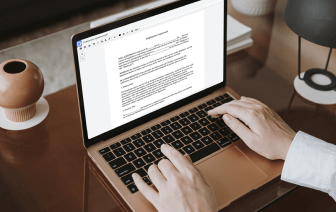

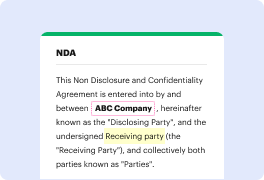

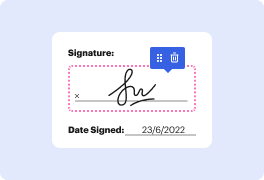

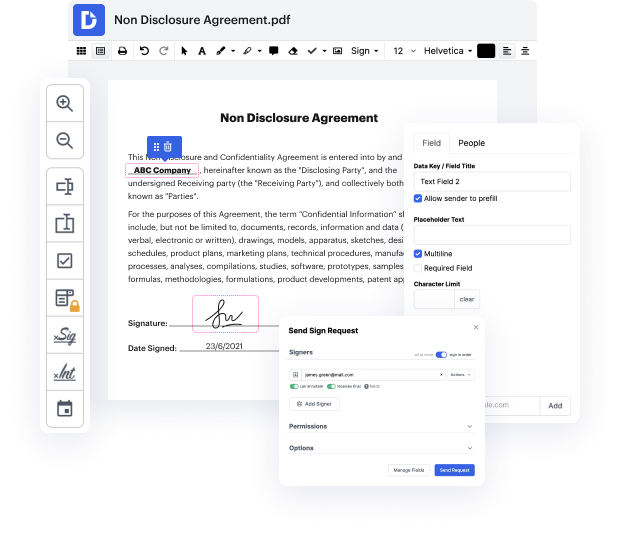

With DocHub, you can easily fill in FATCA in aspx from any place. Enjoy features like drag and drop fields, editable textual content, images, and comments. You can collect electronic signatures safely, include an additional level of protection with an Encrypted Folder, and collaborate with teammates in real-time through your DocHub account. Make changes to your aspx files online without downloading, scanning, printing or sending anything.

You can find your edited record in the Documents folder of your account. Prepare, share, print out, or turn your file into a reusable template. With so many robust features, it’s simple to enjoy effortless document editing and management with DocHub.

today we will talk about the foreign account tax compliance act fatka which requires US citizens to file annual reports on any foreign account Holdings and pay any taxes owed on them to prevent tax evasion the foreign account tax compliance Act is a law that requires US citizens living at home or abroad to file annual reports on any foreign account Holdings they have the main goal of fatka is to stop tax evasion the foreign account tax compliance Act was signed into law by President Barack Obama in 2010 as part of the hiring incentives to restore employment hire act hire was largely designed to incentivize businesses to hire unemployed workers unemployment rates had skyrocketed during the 2008 financial crisis fatka seeks to eliminate tax evasion by American individuals and businesses that are investing operating and earning taxable income abroad while it is not illegal to maintain an offshore account failure to disclose the account to the Internal Revenue Service is illegal since the