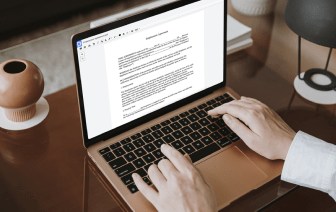

Working with paperwork implies making small corrections to them every day. Occasionally, the job goes nearly automatically, especially when it is part of your daily routine. Nevertheless, in some cases, dealing with an unusual document like a Profit Sharing Plan may take precious working time just to carry out the research. To ensure that every operation with your paperwork is trouble-free and swift, you need to find an optimal editing tool for such tasks.

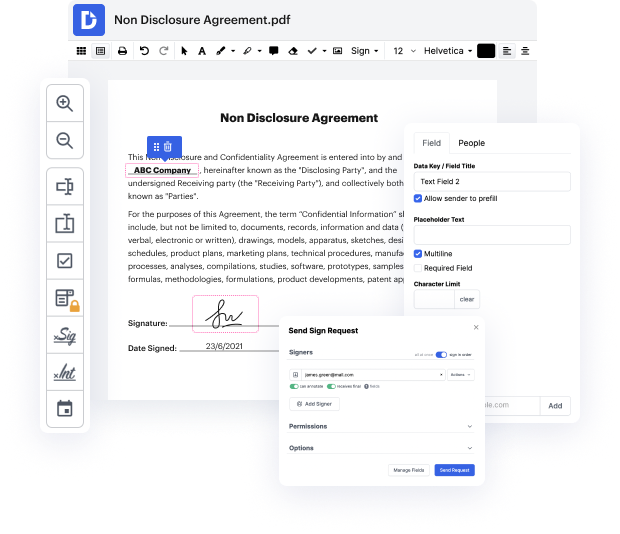

With DocHub, you are able to learn how it works without taking time to figure everything out. Your instruments are organized before your eyes and are readily available. This online tool does not need any sort of background - training or experience - from its customers. It is all set for work even when you are unfamiliar with software traditionally used to produce Profit Sharing Plan. Quickly create, modify, and send out papers, whether you work with them daily or are opening a brand new document type for the first time. It takes moments to find a way to work with Profit Sharing Plan.

With DocHub, there is no need to research different document kinds to figure out how to modify them. Have the go-to tools for modifying paperwork on hand to streamline your document management.

with profit sharing companies can make a decision each year whether or not theyre even going to make contributions to your retirement plan whats up guys sean here and today were answering the question what is it profit sharing plan how does it work and what the contributions even look like youre probably here because your company is offering you a profit sharing plan but youre a little bit confused on why profit sharing plan actually is a profit sharing plan its just a defined contribution plan that allows companies to help employees save for retirement but with this type of retirement plan contributions from your employer is discretionary this means your employer can decide each year how much were going to be contributing and whether or not theyre even going to be contributing to your retirement plan and if the company doesnt make a profit theyll have to contribute to your plan this flexibility makes a great retirement plan option for small businesses or businesses of any s