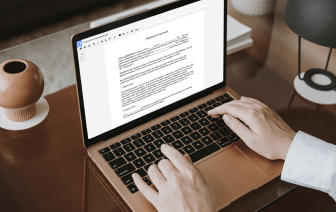

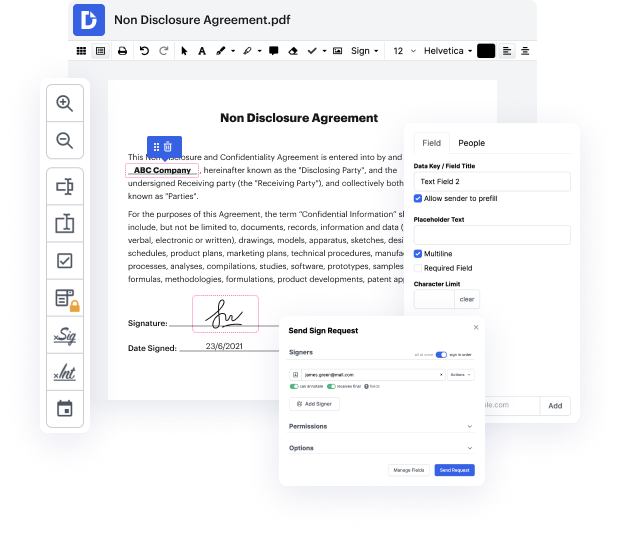

Regardless of how complex and challenging to modify your files are, DocHub provides a straightforward way to change them. You can alter any part in your spreadsheet without effort. Whether you need to modify a single element or the entire form, you can rely on our robust tool for fast and quality results.

Moreover, it makes sure that the final form is always ready to use so that you’ll be able to get on with your projects without any delays. Our all-encompassing group of capabilities also includes sophisticated productivity tools and a catalog of templates, letting you make the most of your workflows without the need of losing time on routine operations. On top of that, you can gain access to your papers from any device and integrate DocHub with other apps.

DocHub can handle any of your form management operations. With an abundance of capabilities, you can generate and export paperwork however you prefer. Everything you export to DocHub’s editor will be stored safely as much time as you need, with rigid security and information safety protocols in place.

Check DocHub now and make managing your files more seamless!

hi everyone welcome to the session in this session letamp;#39;s look at how to calculate irr net present value and payback period by using excel formulas okay so first of all weamp;#39;ll calculate irr before that letamp;#39;s assume our cost of capital as nine percent okay then weamp;#39;ll move on to uh the calculation of irr you are given the free cash flows the cash inflow minus cash outflow will be the free cash flow the net free cash flow and also you are given the cumulative free cash flow in order to calculate irr you need to use the irr function use irr function just take the free cash flow from year 0 to year 10. so thereby you can identify your irr irr is 14 okay to identify net present value what you can do is you can use npv function then you need to use the the cost of capital which is the rate okay then you have to select uh the free cash flow from year 1 to year 10 first of all we need to identify the percent value of the cash uh the positive cash flows then