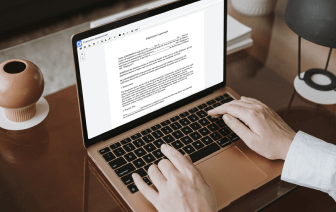

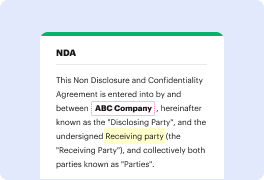

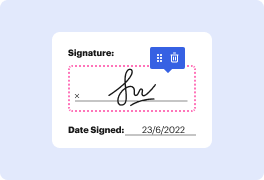

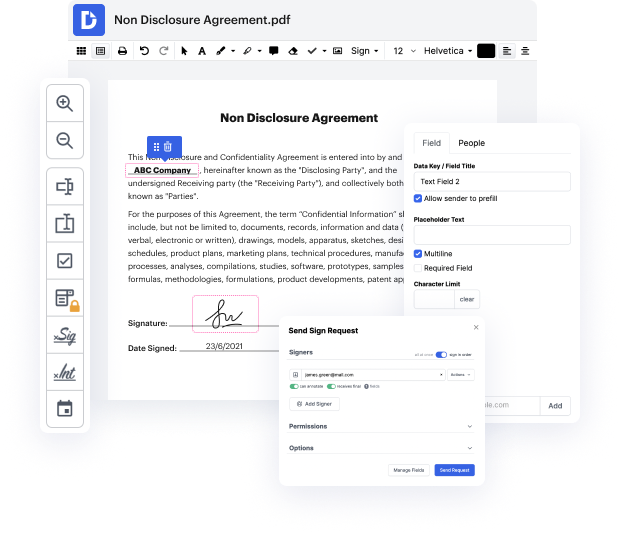

You know you are using the right document editor when such a basic task as Excise link invoice does not take more time than it should. Editing files is now an integral part of a lot of working operations in various professional areas, which is the reason convenience and efficiency are essential for editing tools. If you find yourself researching manuals or searching for tips about how to Excise link invoice, you might want to get a more intuitive solution to save time on theoretical learning. And here is where DocHub shines. No training is needed. Just open the editor, which will guide you through its principal functions and features.

A workflow becomes smoother with DocHub. Take advantage of this instrument to complete the documents you need in short time and get your efficiency one stage further!

[Music] [Music] [Music] welcome to another fast tracks webinar event we do every friday at 9 a.m central eastern where we cover various topics of the fast track software see a list of all these events if you go to our website fdx.com use the ftx lifeline tab at the top of the screen scroll down halfway about this next page choose the webinar button this page will have a you can choose to sign up for notification of our upcoming webinars subscribing a notified link as well as a list of all of our upcoming webinars that you can register for and a list of all of our previously done webinars where you can view the recording today were going to be over going over invoice excise taxes in retail this is a new feature thats coming out next week to get to this just open director and make sure to enable it first and to enable it you have to be an administrator so your director login has to be checkboxed as admin we can see that if we go to maintenance and logins we have that admin checkbox no