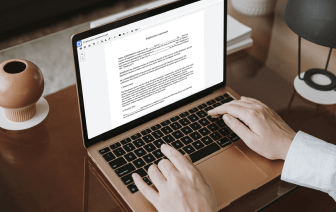

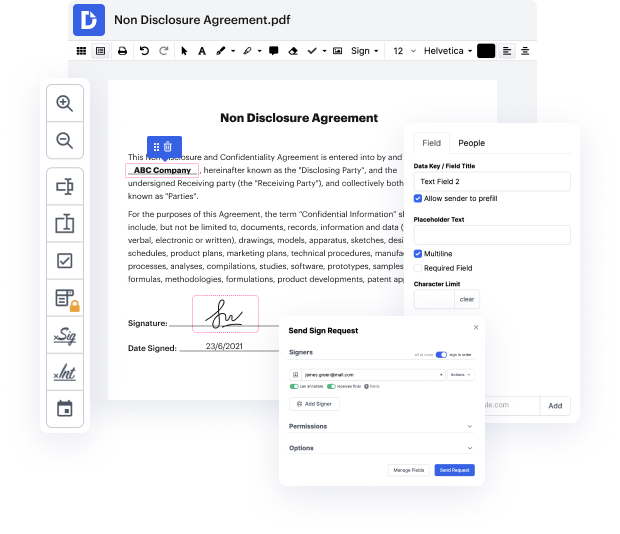

Document editing comes as an element of many occupations and jobs, which is why instruments for it should be reachable and unambiguous in their use. A sophisticated online editor can spare you plenty of headaches and save a substantial amount of time if you want to Excise equation contract.

DocHub is a great demonstration of a tool you can grasp in no time with all the important features accessible. Start editing immediately after creating your account. The user-friendly interface of the editor will help you to find and use any function right away. Feel the difference using the DocHub editor as soon as you open it to Excise equation contract.

Being an integral part of workflows, file editing must remain straightforward. Using DocHub, you can quickly find your way around the editor and make the required changes to your document without a minute wasted.

hi this is matt davies and what were going to talk about today is a little more closing statement math um were going to calculating excise tax and so the first step step-by-step instructions on how to do this would be to take the sales price and divide by 500 and then round up fairly simple uh simple steps here so for example sean seller listed his home for 350 000 and signed a contract for 344.9 how much excise tax will the buyer pay and before you start doing your calculations how much will the buyer pay zero because the buyer does not pay excise tax so somewhat of a trick question and the thing that we want to remember is read the question read the darn problem so remember that read the darn problem and that what is the question that we have to answer how much the buyer will pay well lets flip it now and say what the seller will pay so we dont lose this so weve listed it for 350 the way we calculate is on the sales price so were going to take the 3449 divide that by 500 and y