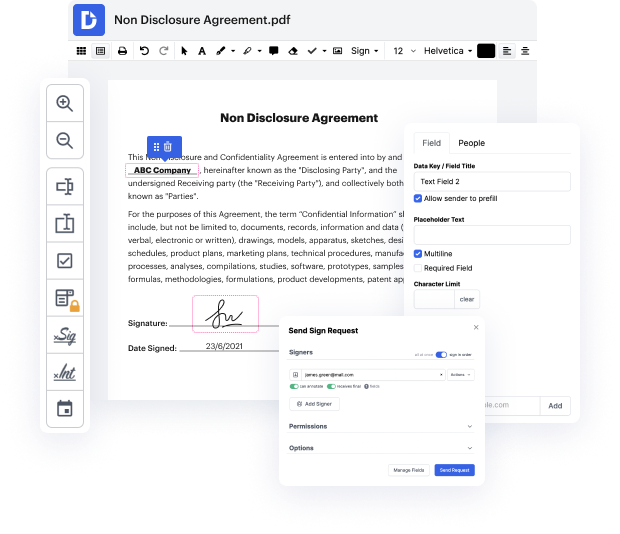

Contrary to popular belief, working on documents online can be hassle-free. Sure, some file formats might appear too challenging with which to work. But if you get the right solution, like DocHub, it's straightforward to edit any file with minimum effort. DocHub is your go-to solution for tasks as simple as the option to Excise Amount Attestation For Free a single document or something as intimidating as processing a massive pile of complex paperwork.

When it comes to a solution for online file editing, there are many options out there. Yet, not all of them are powerful enough to accommodate the needs of individuals requiring minimum editing capabilities or small businesses that look for more extensive set of features that enable them to collaborate within their document-based workflow. DocHub is a multi-purpose service that makes managing paperwork online more streamlined and easier. Try DocHub now!

In this video, the concept of excise taxes is discussed. Excise taxes are specific taxes imposed on certain goods and services, such as fuel, alcohol, cigarettes, air travel, and phone service. Unlike a general sales tax, excise taxes target specific items. These taxes can be quite high, for example, a $1.00 federal excise tax on a pack of cigarettes. Excise taxes can be imposed at both the federal and state level.

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more