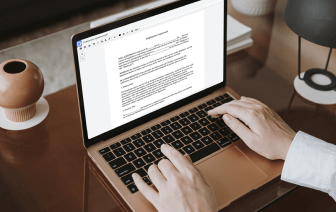

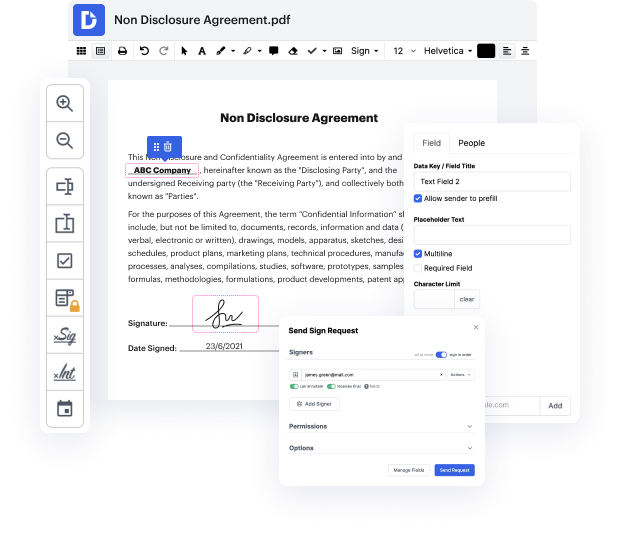

The struggle to manage Credit Agreement can consume your time and effort and overwhelm you. But no more - DocHub is here to take the hard work out of altering and completing your documents. You can forget about spending hours adjusting, signing, and organizing paperwork and worrying about data security. Our solution provides industry-leading data protection procedures, so you don’t need to think twice about trusting us with your sensitive info.

DocHub works with various data file formats and is accessible across multiple platforms.

[Music] trust between the buyer and seller is vital in international trade a letter of credit or lc is an important document in international trade it enables trust between buyers and sellers across different countries an lc is issued by a bank on the buyers behalf and guarantees that the seller will receive payment after he completes his end of the transaction if the buyer is unable to pay the issuing bank is liable to pay the seller why is a letter of credit required the seller is ensured that he will receive funds whereas the buyer gets to demonstrate his credit worthiness and negotiate longer payment terms to understand how a letter of credit works lets take an example mr a an indian exporter enters into a contract for the sale of rice with mr b a u.s importer to assure mr a of timely payment mr b goes to his bank to open an lc the bank is also called an issuing bank or opening bank the issuing bank sends the lc to mr as bank also known as the advising bank after reviewing the t