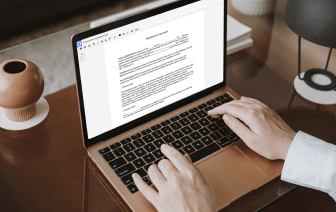

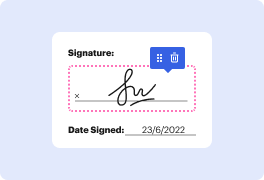

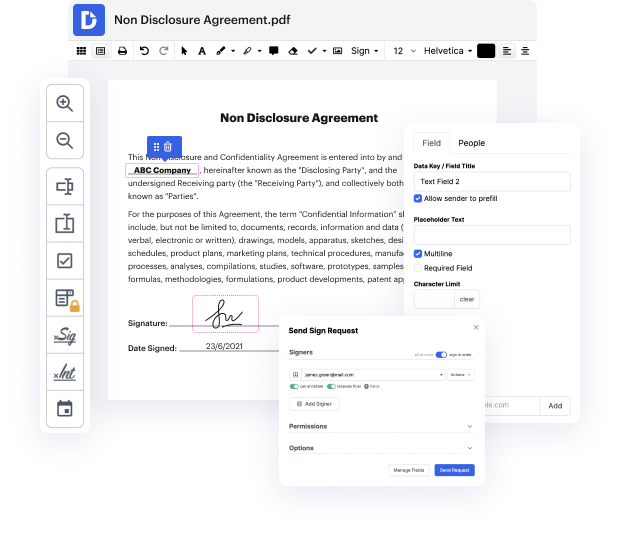

Whether you work with documents daily or only from time to time need them, DocHub is here to help you take full advantage of your document-based tasks. This tool can enter table in Promissory Note Template, facilitate collaboration in teams and create fillable forms and valid eSignatures. And even better, everything is kept safe with the top safety requirements.

With DocHub, you can access these features from any location and using any platform.

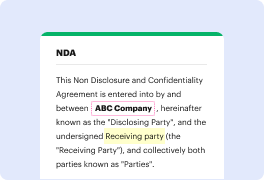

former Sri note is a document that details money borrowed from a lender and the repayment structure there are two types of promissory notes secured and unsecured a secured note is an agreement for borrowed money with the condition that if it is not paid back to the lender then the security which is usually an asset or property is turned over to the lender unsecured promissory note an unsecured note does not allow the lender to secure an asset for money loaned this means that if the payment is not made by the borrower that the lender would have to either file in small court or other legal processes a per mystery no confers many benefits including certainty of payment marketability judicial certainty under the Uniform Commercial Code or the UCC which sets out the requirements for the negotiability the borrowers obligation to pay must be unconditional and do a definite time therefore there is less likelihood as to the amount owed under the note marketability certain transfer ease of nego