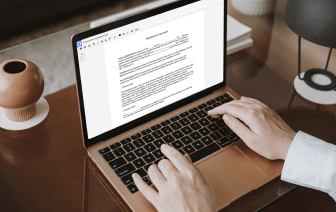

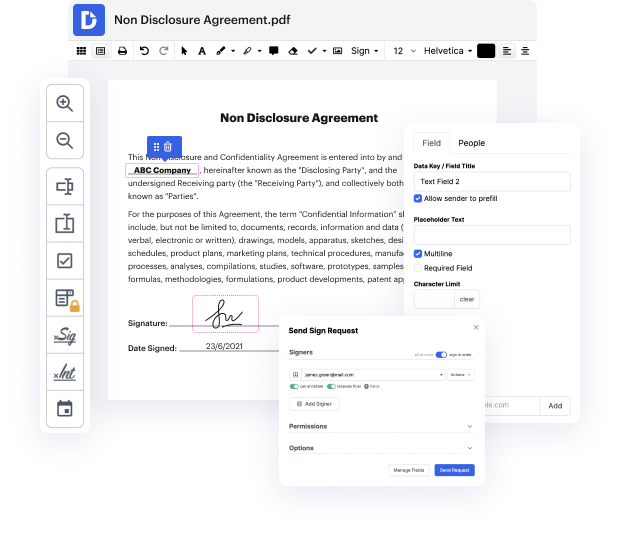

DocHub allows you to embed logo in Annual Report Template – Foreign for Profit swiftly and quickly. No matter if your document is PDF or any other format, you can easily alter it leveraging DocHub's easy-to-use interface and powerful editing features. With online editing, you can alter your Annual Report Template – Foreign for Profit without the need of downloading or installing any software.

DocHub's drag and drop editor makes customizing your Annual Report Template – Foreign for Profit simple and streamlined. We safely store all your edited papers in the cloud, letting you access them from anywhere, whenever you need. Moreover, it's easy to share your papers with people who need to go over them or create an eSignature. And our deep integrations with Google services help you import, export and alter and sign papers right from Google applications, all within a single, user-friendly program. Additionally, you can easily transform your edited Annual Report Template – Foreign for Profit into a template for repetitive use.

All completed papers are safely stored in your DocHub account, are easily handled and shifted to other folders.

DocHub simplifies the process of completing document workflows from day one!

This video will explain how to file an annual report for a for profit corporation with the Division of Business Services. First, go to sos.tn.gov. Hover over Business Services and go down to Business Entity Filings where you can select your organization type. Select For Profit Corporations. This brings you to a page of online services, which includes File an Annual Report. Click on it. This page explains what entities can file annual reports, how to file and what you need to file. Click Start Now! when youre ready. First youll need your secretary of state control number. This unique number is how the Division of Business Services tracks entities across the state. You can find this number on your annual report filing courtesy reminder. Enter it and click Begin. The next screen confirms you are filing an annual report for the correct entity. If its right, click Continue or Cancel to start over. On the first tab you have the option to correct any errors with your Princi