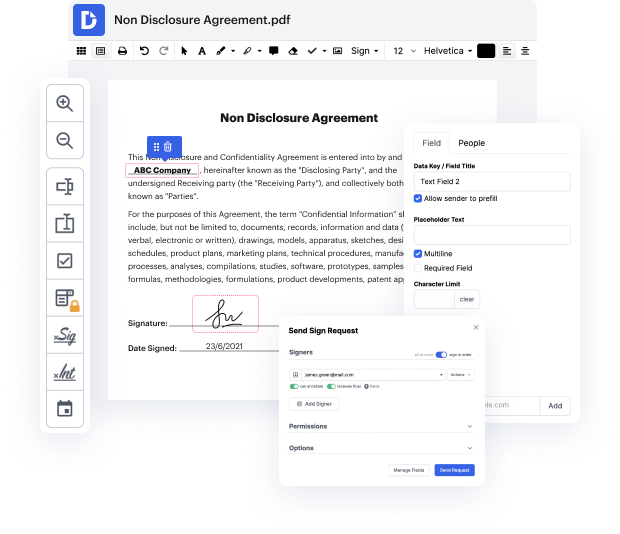

Many companies neglect the advantages of complete workflow application. Usually, workflow programs center on one particular aspect of document generation. There are greater choices for many sectors which require an adaptable approach to their tasks, like Deferred Compensation Plan preparation. Yet, it is achievable to identify a holistic and multifunctional option that can deal with all your needs and requirements. For instance, DocHub can be your number-one option for simplified workflows, document creation, and approval.

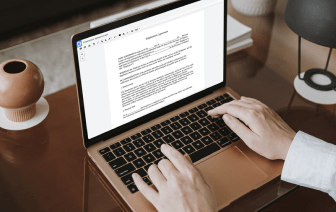

With DocHub, it is possible to create documents from scratch with an extensive set of instruments and features. It is possible to easily edit writing in Deferred Compensation Plan, add feedback and sticky notes, and track your document’s advancement from start to finish. Quickly rotate and reorganize, and merge PDF files and work with any available formatting. Forget about trying to find third-party platforms to deal with the standard needs of document creation and utilize DocHub.

Take full control of your forms and documents at any moment and make reusable Deferred Compensation Plan Templates for the most used documents. Take advantage of our Templates to prevent making common mistakes with copying and pasting the same info and save time on this cumbersome task.

Improve all your document procedures with DocHub without breaking a sweat. Find out all opportunities and functions for Deferred Compensation Plan administration today. Begin your free DocHub account today without hidden fees or commitment.

- What is a 457 or a deferred comp? Were getting into it in this video. (upbeat music) A 457 is very similar to a 401(k), but its for state or government employees. And we talked about 403bs. You can actually look at the video up here if youre interested in that. And the unique thing about school boards is theyre state employees, but they can also have 403bs and 457. So sometimes youll see both. But if youre not in the school board, you probably just have a 457 available to you. What a 457 is, is its basically a government 401(k), but theres a few different distinctions. First of all, if youre still working with a 403(b) or a 401(k), you can actually get access to your money at age 59 and a half without a tax folio. If youre still working at 457, you have to wait until age 70 to get access to your money. But for those of you retiring early this is really important because we have a lot of firefighters and police officers and other government employees that can retire early y