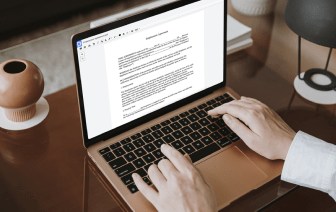

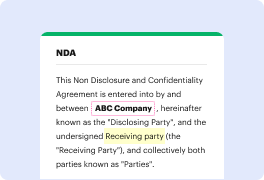

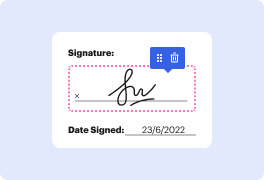

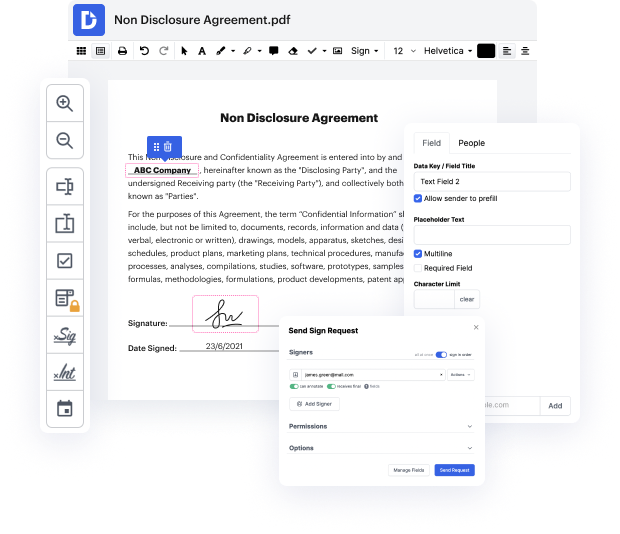

Document-based workflows can consume a lot of your time, no matter if you do them routinely or only from time to time. It doesn’t have to be. In reality, it’s so easy to inject your workflows with extra efficiency and structure if you engage the proper solution - DocHub. Sophisticated enough to tackle any document-related task, our software lets you adjust text, pictures, notes, collaborate on documents with other users, create fillable forms from scratch or web templates, and digitally sign them. We even protect your information with industry-leading security and data protection certifications.

You can access DocHub tools from any place or device. Enjoy spending more time on creative and strategic work, and forget about cumbersome editing. Give DocHub a try right now and watch your Money Loan Contract workflow transform!

this is financial advisor Patrick Monroe talking about signature loans signature loans are uh a great opportunity for someone to uh uh work with a financial institution that believes in them the reason they believe in them is because theyve got great credit uh that they have uh demonstrated themselves to the financial institution uh that theyre a good credit risk and uh the institution therefore uh gives them a predetermined credit line uh based just on their strength of signature uh its a senior product uh for individuals that are creditworthy and uh it is called a Signature Loan uh its an old type loan that was normally uh given to nobility in the past based on the family name but of course we dont live in aristocracy uh type situations anymore in America so the prevailing Benchmark uh for signature loans is your credit and your outstanding this as far as how the financial institution believes in you this is Patrick Monroe talking about the tool known as signature loans