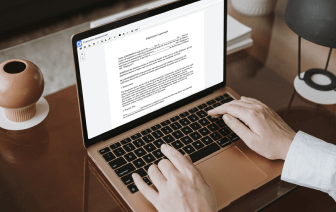

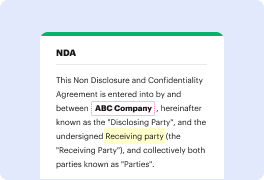

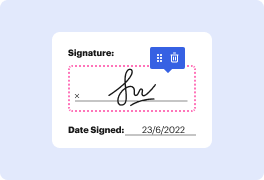

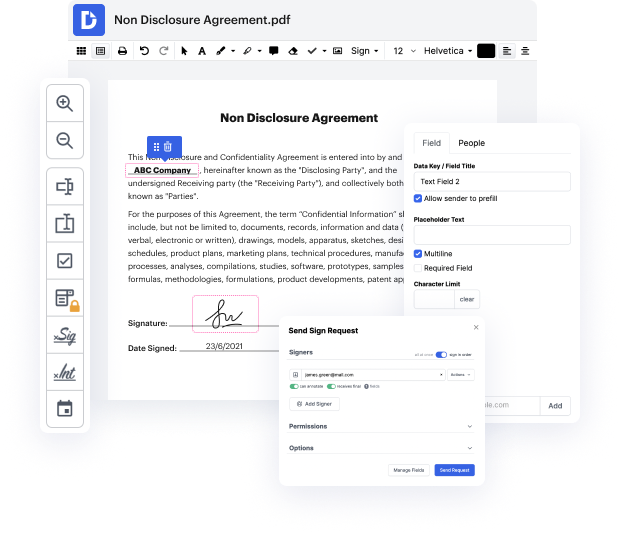

Time is a crucial resource that every organization treasures and attempts to convert into a advantage. When selecting document management software, take note of a clutterless and user-friendly interface that empowers consumers. DocHub gives cutting-edge features to optimize your file administration and transforms your PDF editing into a matter of one click. Delete Value Choice in the Investment Contract with DocHub to save a lot of time as well as enhance your efficiency.

Make PDF editing an simple and intuitive operation that saves you plenty of precious time. Quickly modify your files and send them for signing without the need of turning to third-party alternatives. Focus on relevant duties and increase your file administration with DocHub starting today.

Has this ever happened to you? You enter a trade and set your stop loss at the recent swing low. As if price drops below this point, you don t want to be in the trade anyway. Price ends up falling past that recent swing low, but just barely, and end ups reversing back the way you originally thought it was going to go. Making you miss out on all this profit. Well, here s how to fix that. Go to tradingview. Go to the indicators tab and type in ATR What this indicator does it look at the past candles and measures the average volatility or size of the past candles. You can see that average candle size is displayed right here So what you do, is see what the price is of where you want to set your stop loss, then subtract that number with the atr. This number is where you will set your new stop loss. This way you are taking volatility and average price movement into consideration. And you will get stopped out way less.