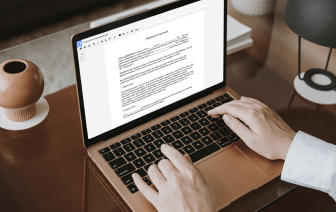

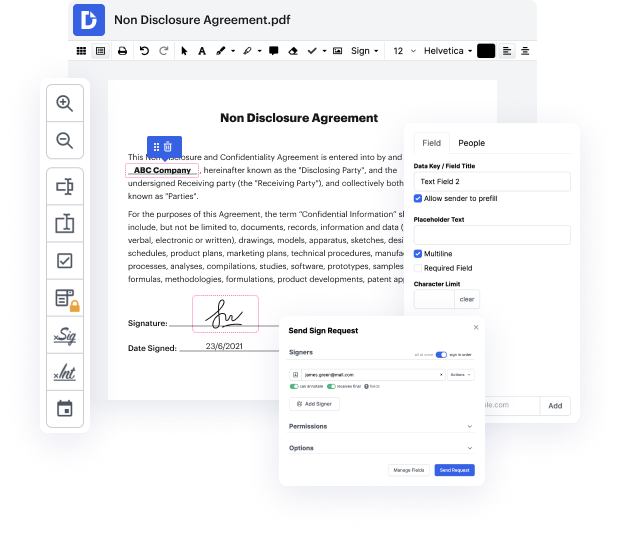

Time is an important resource that every organization treasures and attempts to change in a reward. When selecting document management software, focus on a clutterless and user-friendly interface that empowers customers. DocHub delivers cutting-edge features to enhance your file managing and transforms your PDF file editing into a matter of one click. Delete Payment Field into the General Contractor Agreement with DocHub to save a ton of time and improve your efficiency.

Make PDF file editing an simple and easy intuitive process that helps save you plenty of valuable time. Easily adjust your documents and give them for signing without having switching to third-party options. Give attention to relevant duties and enhance your file managing with DocHub starting today.

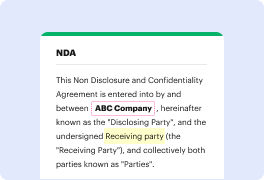

tip number 280 from the book 501 contractor tips some states state of California has a three-day right to cancel the contract your state might not have it if you do have it make sure that you give it to them its a form that you need to attach to your contract or you need to at least have it there so that they are aware of it and this actually gives them three working days to cancel the contract how does it work if you sign a contract on Tuesday then they would have Wednesday Thursday and Friday if you dont hear from them by Saturday then or the end of the Friday then youre good to go on the project however if you sign a contract on Friday Saturday and Sunday do not count you would have to wait Monday Tuesday and Wednesday to get the tip to know for sure that theyre not gonna cancel a contract if I was doing a big job or a bigger job I wouldnt start the contract I mean I wouldnt start the job I wouldnt do anything and I would make the people aware of it and then they would say he