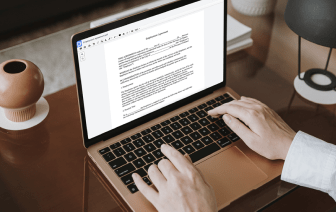

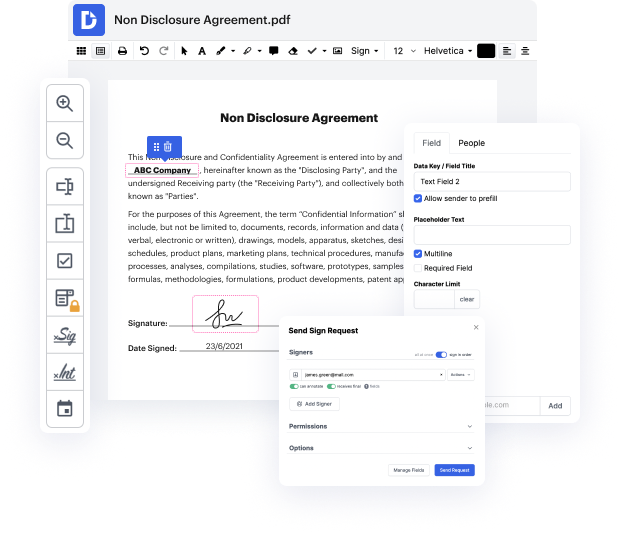

Time is a vital resource that every company treasures and tries to change in a advantage. When picking document management software, be aware of a clutterless and user-friendly interface that empowers users. DocHub delivers cutting-edge features to optimize your file managing and transforms your PDF editing into a matter of one click. Delete Field Settings in the Income Statement Quarterly with DocHub in order to save a ton of efforts and increase your productivity.

Make PDF editing an easy and intuitive operation that helps save you a lot of valuable time. Easily modify your files and deliver them for signing without adopting third-party options. Concentrate on pertinent tasks and enhance your file managing with DocHub right now.

hello everyone and welcome to this video in this video we will actually import the income statement quarterly income statement from actual quarter file but before that lets do a small change we have actually committed a small mistake in previous video we want to forecast next five years and till now we have the data till september 2021 so when we have to forecast five years so we will be actually forecasting till december 2026 so what we need to do we need to drag it four more quarters okay till now and now we also want to hide these columns these columns are not required so we can actually hide them so press ctrl space here ctrl shift right arrow key all the columns have been selected press ctrl 0 to hide all the columns right now just check this these columns are now hidden one more small change i want to do here when i have my actual year below this row so i want to format it a bit instead of showing all the four digits of the year i will show only two digits okay so select till no