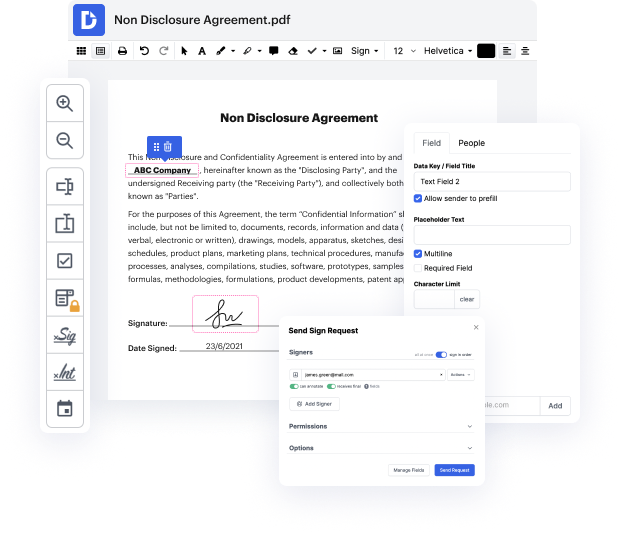

Time is a crucial resource that every organization treasures and attempts to convert into a advantage. In choosing document management software, be aware of a clutterless and user-friendly interface that empowers users. DocHub offers cutting-edge instruments to optimize your document managing and transforms your PDF editing into a matter of a single click. Delete Currency to the Demand with DocHub in order to save a ton of efforts and boost your productiveness.

Make PDF editing an simple and intuitive process that will save you a lot of valuable time. Quickly adjust your documents and send them for signing without the need of turning to third-party solutions. Concentrate on relevant duties and increase your document managing with DocHub starting today.