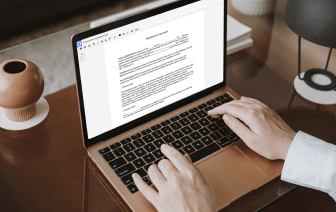

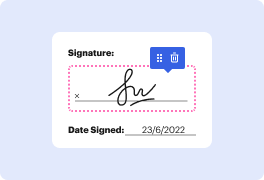

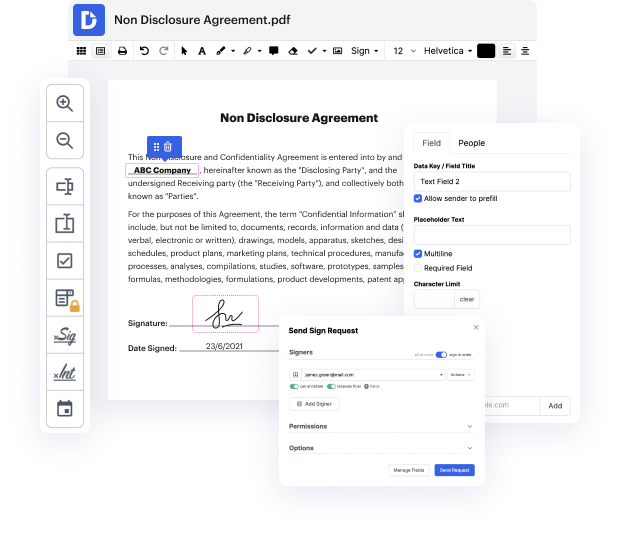

Time is a crucial resource that each enterprise treasures and tries to transform into a reward. When picking document management software, focus on a clutterless and user-friendly interface that empowers customers. DocHub delivers cutting-edge features to improve your file management and transforms your PDF editing into a matter of a single click. Delete Calculated Field to the Bank Loan Proposal with DocHub to save a ton of time as well as boost your productiveness.

Make PDF editing an simple and easy intuitive operation that will save you plenty of precious time. Effortlessly modify your files and send out them for signing without the need of looking at third-party solutions. Give attention to pertinent duties and improve your file management with DocHub right now.

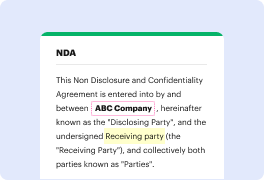

hey everybody its Joe bata here Im just gonna wait a little moment and see if we have anybody hop on the call today were gonna be talking about the three things that the bank must see in order to get a mortgage and this is specifically for Canada and this is after youve gone through consumer proposals gonna do some adjustments here do it a little better there okay so three things that the bank must see on your credit history after your consumer proposal does anybody want to take a stab at it I can tell you that one thing for sure is that the bank will absolutely be more vigilant in verifying all details on your credit bureau after they see that youve gone through a consumer proposal as a mortgage broker in in Ontario Canada I see a lot of folks that go through consumer proposals and come to me after theyve gone through the consumer proposal say three or four years ago and and they cant get a mortgage through their bank and they come to me to ask what happened so the big thing tha