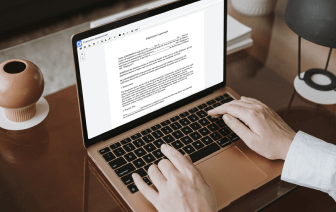

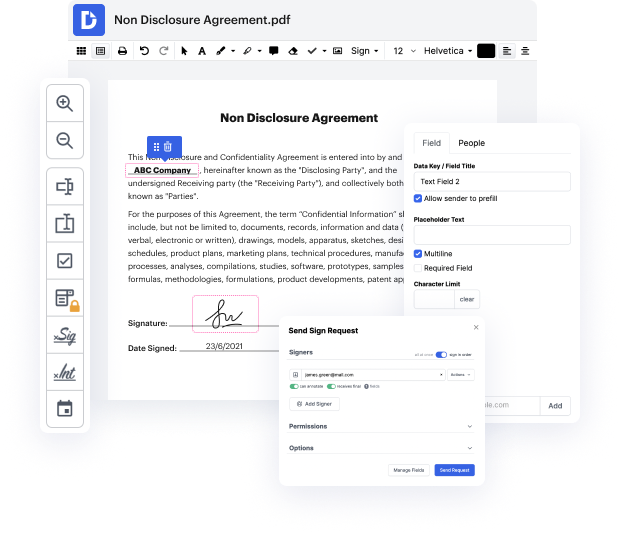

Time is an important resource that each organization treasures and tries to transform into a reward. When selecting document management application, be aware of a clutterless and user-friendly interface that empowers users. DocHub gives cutting-edge instruments to improve your document management and transforms your PDF editing into a matter of one click. Delete Advanced Field to the Bonus Program with DocHub in order to save a lot of time and increase your efficiency.

Make PDF editing an simple and easy intuitive process that saves you plenty of valuable time. Easily modify your documents and send them for signing without the need of turning to third-party alternatives. Give attention to relevant duties and boost your document management with DocHub starting today.

in this video were going to be talking about how to max out your Facebook performance bonus so that if you have the Facebook performance bonus you can earn that 30 000 now Facebook is still testing this bonus and theyre doing a lot of different things with it changing things and Im talking to creators in the Facebook group all the time about it if youre not in the Facebook group make sure you join the Facebook group so that you can engage with other content creators who have the Facebook performance bonus and learn about whats going on because Facebook is not sharing a lot of information about it right now because theyre still testing it but one thing I want to let you know is that its totally possible to match that bonus out and if not Max it out make several thousands of dollars every single month with the Facebook performance bonus theyre people who are subscribed to this channel doing that right now and Im gonna share with you some things that you need to do right now to t