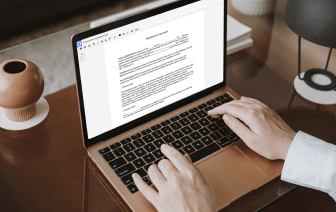

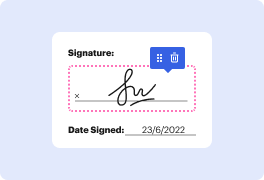

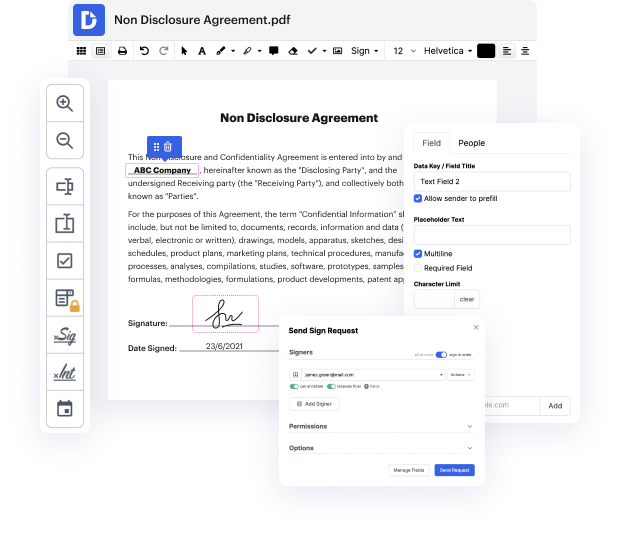

With DocHub, you can quickly cut off payee in DWD from any place. Enjoy capabilities like drag and drop fields, editable text, images, and comments. You can collect electronic signatures safely, include an additional layer of defense with an Encrypted Folder, and work together with teammates in real-time through your DocHub account. Make changes to your DWD files online without downloading, scanning, printing or sending anything.

You can find your edited record in the Documents folder of your account. Edit, email, print out, or turn your file into a reusable template. With so many advanced tools, it’s simple to enjoy effortless document editing and managing with DocHub.

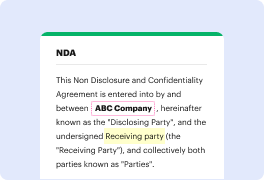

the information printed on your bill is all you need to set up a company as a payee known payees are companies pre-loaded into our database while unknown companies are manually added using their contact information to add a known company click the add a company or person button and select the company from the provided list enter the required information keep in mind the required information fields change depending on the company youamp;#39;re adding click the add button to create the payee to add an unknown company click the add a company or person button you can select the mail a check link if they do not accept electronic payments or select a company type from the list and then select other company enter the payeeamp;#39;s name account number street address and city select the state using the drop-down then enter the payee zip code phone number and email address click the add button when you are finished your new payee will now show up in the list on the left side of the payment ce