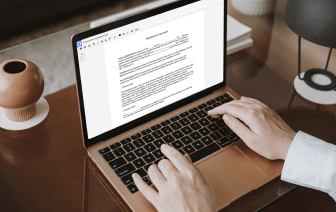

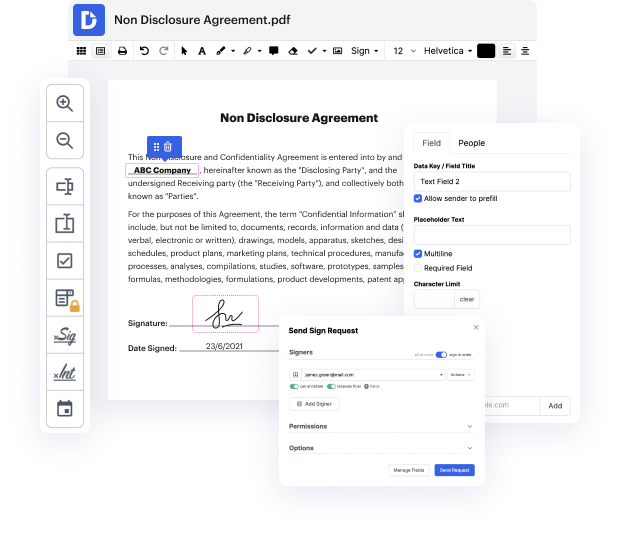

Do you need a quick and easy method to cut expense in Community Service Letter? Your search is over - DocHub gets the job done fast, without any complex software. You can use it on your mobile phone and PC, or internet browser to modify Community Service Letter anytime and anywhere. Our versatile software package includes everything from basic and advanced editing to annotating and includes safety measures for individuals and small companies. We provide tutorials and instructions that help you get your business up and running without delay. Working with DocHub is as simple as this.

Easy, right? Even better, you don't need to be concerned about data safety. DocHub offers quite a number of capabilities that help you keep your sensitive data risk-free – encrypted folders, two-factor authorization, and more. Enjoy the bliss of getting to your document management objectives with our reliable and industry-compliant solution, and kiss inefficiency goodbye. Give DocHub a try right now!

hiya Dinah high school this is Mary Fink my rule at Dinah is organizing the community service letter and the purpose of this video is to introduce you to the service letter and hopefully inspire you to apply this year so to start off the community service letter is an award and it is given to students who make a docHub contribution to service work so if you complete 120 hours of service you can earn this award Id like to start off by sharing with you the mission statement our mission is to support and create active and responsible citizens the goal of the community service letter is to ensure that each student makes a meaningful commitment to a social issue that is relevant to their lives next up Im going to share with you to students who lettered last year and theyve each agreed to give a short testimony about their experience so first up is Miriam Diaby Ill let you read her testimony here you you all right were also gonna read the testimony of Nick Yellin you okay so just i