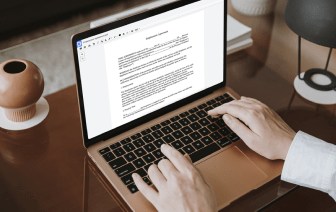

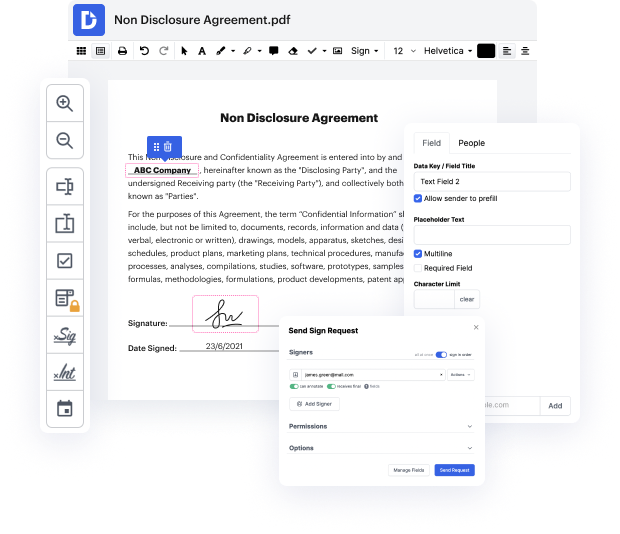

At first sight, it may seem that online editors are roughly the same, but you’ll discover that it’s not that way at all. Having a powerful document management solution like DocHub, you can do far more than with traditional tools. What makes our editor so special is its ability not only to promptly Cut card in Debt Settlement Agreement Template but also to design documentation totally from scratch, just the way you want it!

Regardless of its extensive editing features, DocHub has a very easy-to-use interface that offers all the features you need at your fingertips. Therefore, adjusting a Debt Settlement Agreement Template or a completely new document will take only a few moments.

Register for a free trial and enjoy your greatest-ever paperwork-related experience with DocHub!

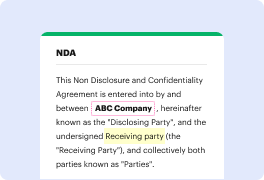

A debt settlement agreement is generally used to confirm a renegotiation or settlement of the original agreement between the debtor and the creditor. A debt settlement agreement usually reduces or eliminates the original amount of debt between the parties and allows the creditor to forgive part of the debt by releasing the debtor from any remaining obligation. Usually in exchange of the last payment made by the debtor to the creditor after the execution of the debt settlement a. The creditor should remove any obligation of the debtor under the original contract and renounced to pursue any auction against the debtor in relation to the original agreement.