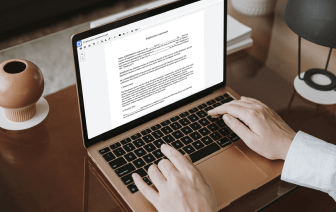

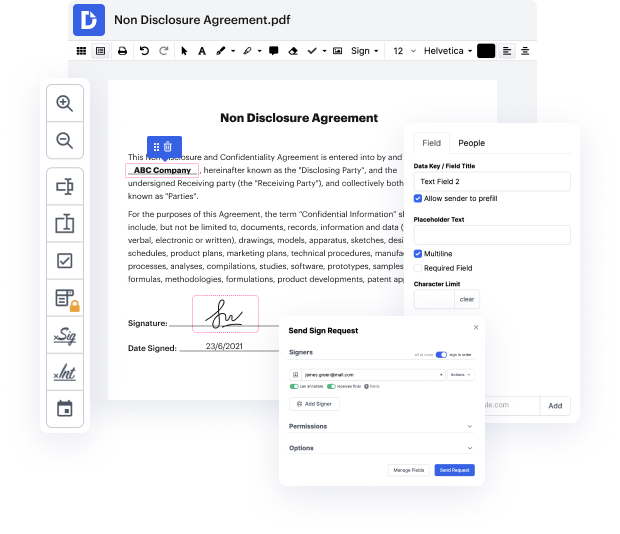

Are you searching for a straightforward way to correct title in Stock Plan? DocHub provides the best solution for streamlining document editing, certifying and distribution and document execution. Using this all-in-one online program, you don't need to download and install third-party software or use complex document conversions. Simply upload your document to DocHub and start editing it with swift ease.

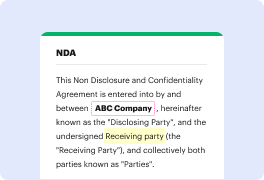

DocHub's drag and drop user interface allows you to swiftly and quickly make modifications, from easy edits like adding text, graphics, or graphics to rewriting entire document pieces. You can also endorse, annotate, and redact paperwork in a few steps. The solution also allows you to store your Stock Plan for later use or transform it into an editable template.

DocHub provides more than just a PDF editing program. It’s an all-encompassing program for digital document management. You can use it for all your paperwork and keep them safe and swiftly accessible within the cloud.

hi Im Steve Stig itis with crusher Miller today were going to talk about some phantom stock basics why what a phantom stock is why its used and when you would use it basically phantom stock is a form of deferred compensation meaning a participant earns a current benefit that is paid at a latter point in time the typical structure and a phantom stock arrangement involves an employer entering into an agreement with an employee the employer then issues a predetermined number of units to that employee the units are valued based upon a formula dictated in the agreement as the value of the company increases so does the value of the units triggering events are written into the agreement that dictate how and when an employee may receive those benefits phantom stock is part of a long-term compensation package typically identified four key employees of a company its used to help retain those key employees helped align the goals of management with the owners and lastly help create value for