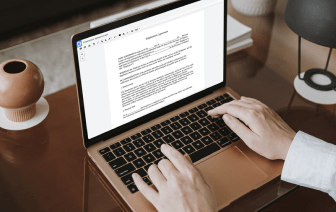

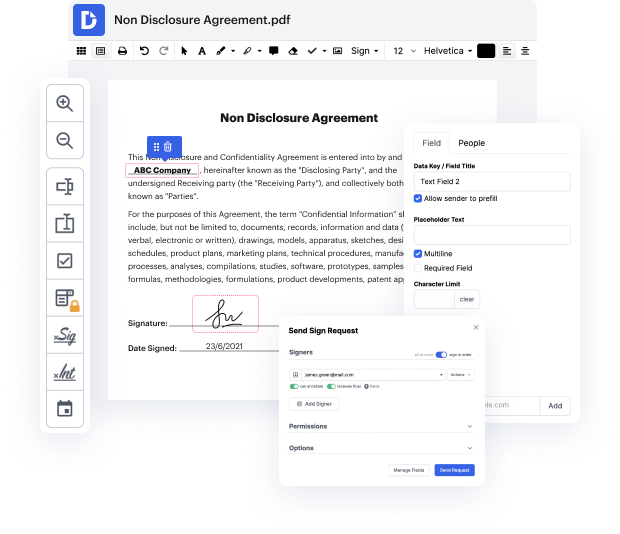

Choosing the excellent file administration solution for your company could be time-consuming. You must analyze all nuances of the software you are thinking about, evaluate price plans, and stay vigilant with security standards. Arguably, the ability to work with all formats, including xml, is essential in considering a solution. DocHub provides an extensive set of features and tools to ensure that you deal with tasks of any complexity and handle xml format. Get a DocHub account, set up your workspace, and begin dealing with your documents.

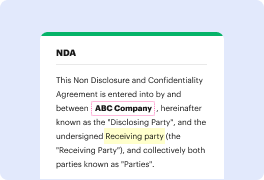

DocHub is a extensive all-in-one app that allows you to edit your documents, eSign them, and create reusable Templates for the most frequently used forms. It offers an intuitive user interface and the ability to deal with your contracts and agreements in xml format in the simplified mode. You do not need to worry about studying numerous guides and feeling stressed out because the software is too sophisticated. correct ein in xml, assign fillable fields to specified recipients and gather signatures effortlessly. DocHub is about potent features for specialists of all backgrounds and needs.

Enhance your file generation and approval procedures with DocHub right now. Benefit from all of this using a free trial and upgrade your account when you are all set. Modify your documents, produce forms, and discover everything you can do with DocHub.

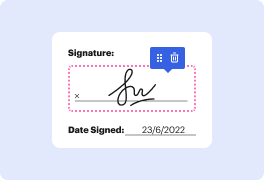

need to change information on your ein number let me show you how to do that you want to get form 8822b on the irs website click box one if youre if youre changing the address also click box three the old information goes at the top the new information goes in box six if youre changing the person whos responsible for the ein its gonna go on box eight and nine and youre gonna mail it to these locations depending on where you live remember keep all your information consistent