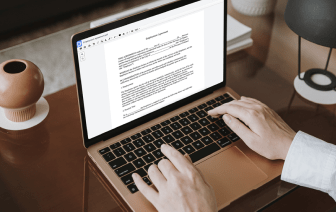

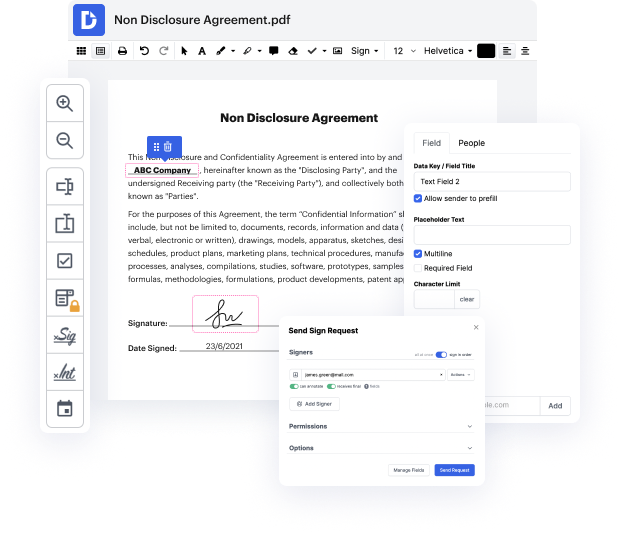

Do you want to prevent the challenges of editing 1099-MISC Form online? You don’t have to worry about installing unreliable solutions or compromising your paperwork ever again. With DocHub, you can copy table in 1099-MISC Form without spending hours on it. And that’s not all; our easy-to-use platform also offers you powerful data collection tools for gathering signatures, information, and payments through fillable forms. You can build teams using our collaboration capabilities and effectively interact with multiple people on documents. Additionally, DocHub keeps your information safe and in compliance with industry-leading protection requirements.

DocHub enables you to access its features regardless of your system. You can use it from your notebook, mobile phone, or tablet and modify 1099-MISC Form easily. Start working smarter right now with DocHub!

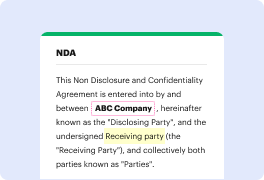

if you got one of these 1099s and youre wondering what the heck is it how does it get taxed and how do we report this thing on our tax return this video is for you and also be sure to stick around to the end of the video so I can let you know how to get it done through TurboTax all right so what the heck is this thing this is a 1099 from the state of California that you received based on what they call the middle class tax refund you should have got this sometime from October to the end of the year now this thing came as either a debit card in the mail or it was a direct deposit into your bank account do we need to pay taxes on this 1099 thats a maybe but what you need to do is report it on your tax return now one thing we are clear about is this amount that you got reported on this 1099 is not taxable by the state of California as you can see here on their website youll see down here right this middle class tax refund is not taxable able for state income tax purposes now we are not