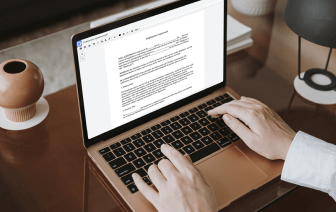

People who work daily with different documents know very well how much productivity depends on how convenient it is to use editing tools. When you IRS Form 1040-ES papers must be saved in a different format or incorporate complicated elements, it might be difficult to handle them using classical text editors. A simple error in formatting may ruin the time you dedicated to copy certification in IRS Form 1040-ES, and such a simple task shouldn’t feel challenging.

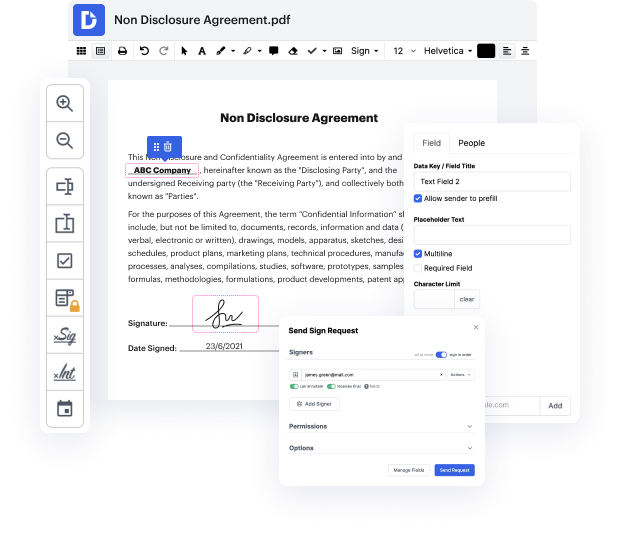

When you discover a multitool like DocHub, such concerns will in no way appear in your projects. This robust web-based editing solution can help you easily handle paperwork saved in IRS Form 1040-ES. You can easily create, edit, share and convert your files anywhere you are. All you need to use our interface is a stable internet access and a DocHub profile. You can sign up within minutes. Here is how straightforward the process can be.

Having a well-developed editing solution, you will spend minimal time finding out how it works. Start being productive as soon as you open our editor with a DocHub profile. We will make sure your go-to editing tools are always available whenever you need them.

let me quickly talk to you about irs form 1040es line by line instructions lets talk about estimated tax worksheets for individuals dont go anywhere so [Music] welcome back folks to another edition of the awesome suited q a show how are you today i hope you are doing fantastic im doing marvelous if you ever ask me if you are doing as great as i am go grab a cup of coffee or tea or vodka lets roll in todays conversation i want to talk to you about iris form 1040es estimated tax for individuals what is it i mean as we all know income tax is a pay-as-you-go system so if you are an employee you pay federal withholding as a part of every paycheck right every two weeks or every every week or every 30 days but if you are self-employed you might have to make quarterly estimated tax payments toward the amount you expect to owe the ad rights or you might have and something called an underpayment penalty so this payment should include both your income and self-employment taxes and are repor