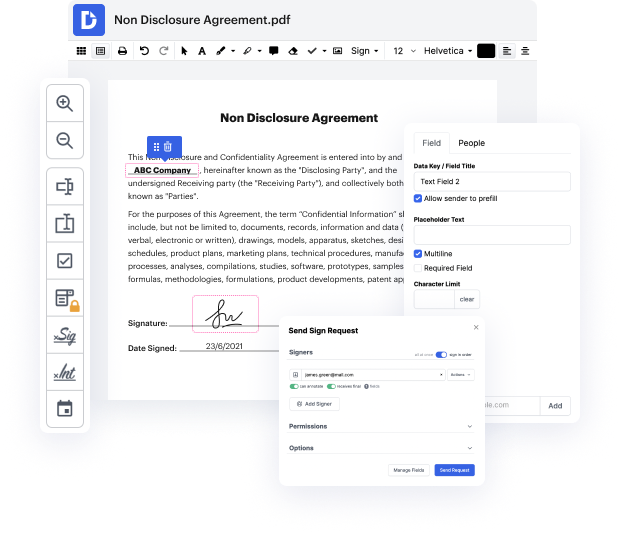

Getting full control over your documents at any time is important to alleviate your day-to-day duties and improve your productivity. Achieve any objective with DocHub features for papers management and practical PDF editing. Access, change and save and integrate your workflows along with other secure cloud storage services.

DocHub provides you with lossless editing, the possibility to use any format, and safely eSign papers without having searching for a third-party eSignature software. Obtain the most from the file management solutions in one place. Try out all DocHub features right now with the free profile.

In this video, Kirby A. Cundiff, an expert in finance, discusses dividends and share repurchase agreements. He outlines three primary theories regarding how companies should set dividends to maximize stock prices: 1. **Dividend Irrelevance Theory**: Proposes that dividend policy does not affect a company's stock price.2. **Bird in the Hand Theory**: Suggests investors prefer companies that pay higher dividends, valuing immediate cash over potential future gains.3. **Tax Preference Theory**: Indicates that investors may favor capital gains over dividends due to the higher tax rates applied to dividends.Cundiff explains how stock prices correlate with these payout theories, referring back to the dividend irrelevance theory as a key concept in this discussion.