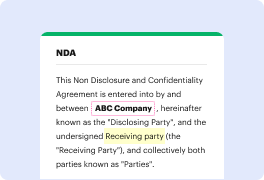

People often need to conceal FATCA in OSHEET when managing documents. Unfortunately, few programs offer the tools you need to complete this task. To do something like this usually requires switching between multiple software applications, which take time and effort. Fortunately, there is a solution that suits almost any job: DocHub.

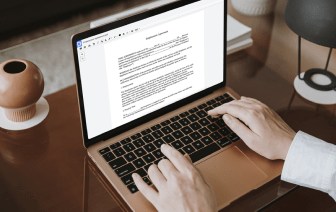

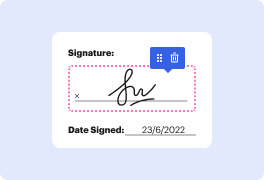

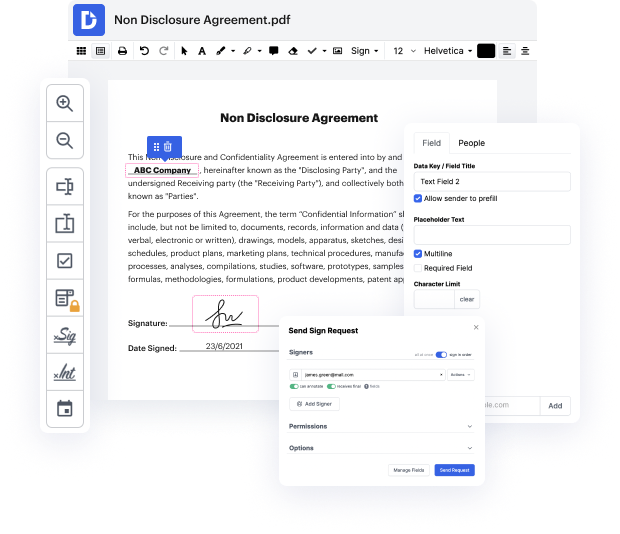

DocHub is a perfectly-built PDF editor with a full set of useful capabilities in one place. Editing, approving, and sharing forms becomes straightforward with our online solution, which you can access from any online device.

By following these five simple steps, you'll have your modified OSHEET rapidly. The intuitive interface makes the process quick and productive - stopping jumping between windows. Start using DocHub today!

have you ever been daydreaming and wondered to yourself what the heck is fatca of course you havenamp;#39;t youamp;#39;re probably wondering what the heck iamp;#39;m talking about right now but if youamp;#39;re a us citizen living abroad you should probably ask yourself this question at least once in your life donamp;#39;t panic thatamp;#39;s why weamp;#39;ve created this video series weamp;#39;ll take care of you and your taxes and thatamp;#39;s a fact or should i say factca do you see what i did there sorry tax joke letamp;#39;s talk fatca fatca thatamp;#39;s foreign account tax compliance act this is a federal law that requires foreign financial institutions like banks to report back the data on their u.s account holders it also requires u.s citizens to disclose this information themselves itamp;#39;s used to prevent illegal money laundering abroad yikes this means that if an american opens an account in a foreign bank that bank must comply with fatca laws so you may fin