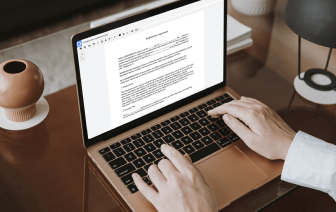

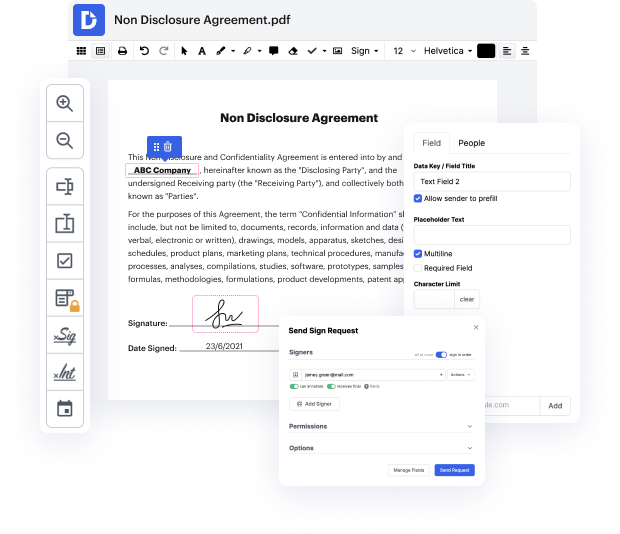

The challenge to handle Donation Receipt can consume your time and effort and overwhelm you. But no more - DocHub is here to take the effort out of altering and completing your paperwork. You can forget about spending hours editing, signing, and organizing paperwork and stressing about data security. Our solution provides industry-leading data protection measures, so you don’t have to think twice about trusting us with your sensitive information.

DocHub supports various data file formats and is accessible across multiple platforms.

hi there my name is Sherry Evans Im the Chief Financial Officer at Goodwill Northern New England and Im also a CPA first off Id like to thank you for donating to Goodwill you may not realize it but you may be able to deduct the items you donate on your tax returns save on your tax liability when you donate at Goodwill you scan the QR code and it will immediately email you a receipt or you may have a paper receipt in which case you just fill out the date in your name and theres a place for the value of the items that youve donated to find the value you can just look on the back of the form or you can go to our website goodwillnne.org now when you file your tax return you would want to itemize deductions instead of taking the standard deduction itemizing deductions is usually most advantageous for folks who own a home and can deduct mortgage interest taxes or people with high out-of-pocket medical costs or those who make large amounts of donations to charities so when you file your