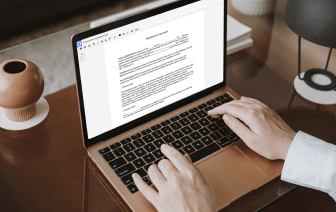

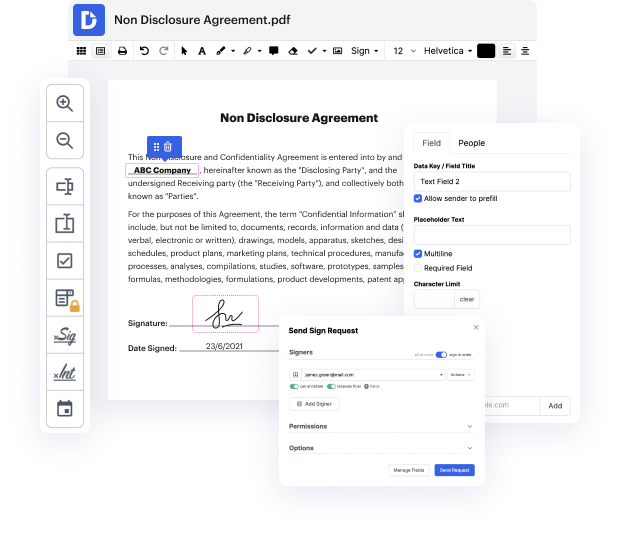

Document-centered workflows can consume a lot of your time and energy, no matter if you do them routinely or only from time to time. It doesn’t have to be. In fact, it’s so easy to inject your workflows with extra productiveness and structure if you engage the right solution - DocHub. Sophisticated enough to tackle any document-related task, our software lets you modify text, images, comments, collaborate on documents with other parties, generate fillable forms from scratch or templates, and digitally sign them. We even shield your information with industry-leading security and data protection certifications.

You can access DocHub tools from any place or device. Enjoy spending more time on creative and strategic tasks, and forget about cumbersome editing. Give DocHub a try today and enjoy your Mortgage Financing Agreement workflow transform!

today youre going to learn how to read a loan estimate lets bring in the big guns and show you how this is done all right lets get started i know that there are a lot of numbers and loan estimates it seems really confusing but im going to break everything down for you and make it really easy okay so the first thing that were going to look at youll see right here and right here weve got the sales price and the loan amount weve got the interest rate and then this only matters if we go here and see if its locked or not so this one is locked now sometimes loan officers dont lock things right away especially if they know that youre shopping um because then your 30-day clock starts so were limited on time we have to really hustle um but thatll tell you if you are not and then here is the date another thing to pay attention to up here is the loan type so we have conventional fha va as you can tell conventional is marked all right so the next important thing is your monthly princi