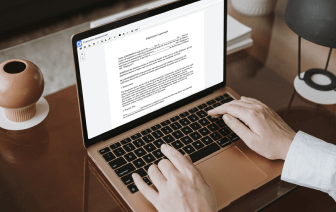

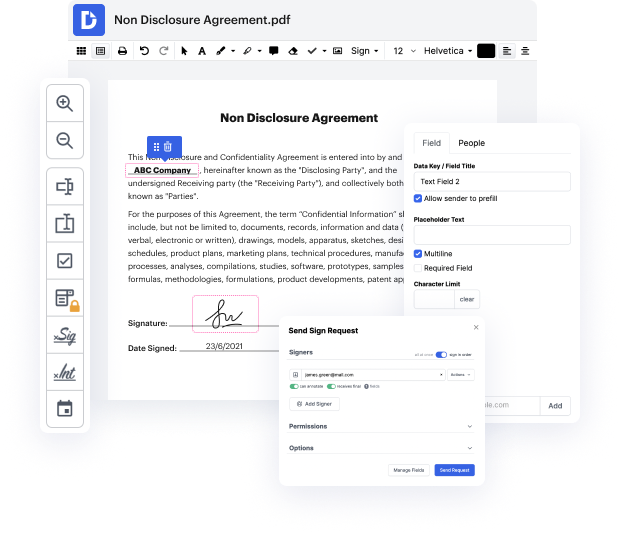

Having complete power over your files at any time is important to alleviate your daily tasks and improve your efficiency. Achieve any goal with DocHub tools for document management and hassle-free PDF file editing. Access, modify and save and incorporate your workflows with other safe cloud storage.

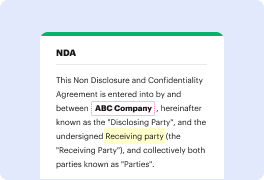

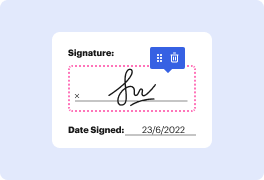

DocHub provides you with lossless editing, the opportunity to use any formatting, and safely eSign documents without the need of searching for a third-party eSignature option. Get the most of the file managing solutions in one place. Check out all DocHub functions today with your free account.

In this lecture, we define a credit memorandum based on accounting principles. A credit memorandum is a notification indicating that the issuer has credited the recipient's account in their records. This signifies to the customer that they owe money, which the company is now reducing for a specific reason. The term "credit" in the credit memorandum refers to a decrease in the accounts receivable ledger for that customer. For example, if a customer purchases inventory and gives an IOU, the transaction would increase accounts receivable and sales, while decreasing inventory. Thus, the credit memorandum reflects a reduction in the amount owed by the customer.