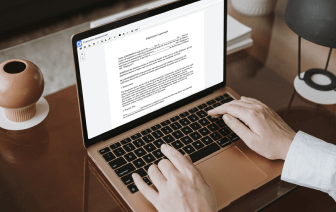

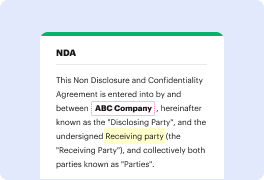

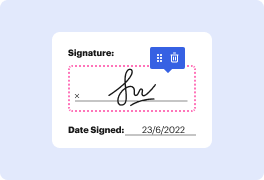

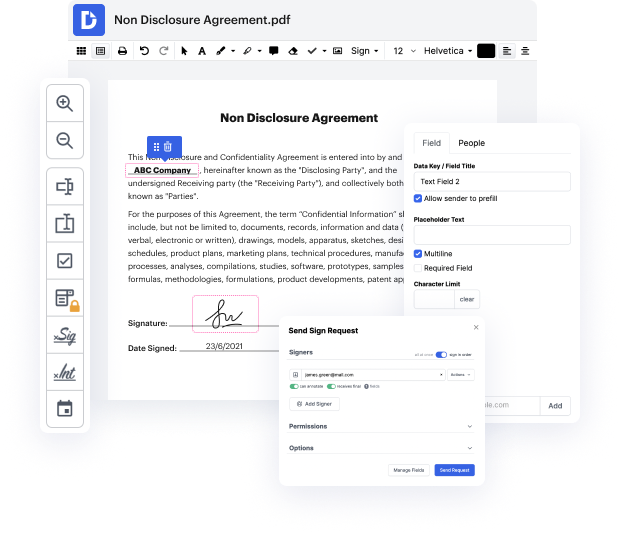

Of course, there’s no ideal software, but you can always get the one that perfectly combines powerful capabilitiess, ease of use, and reasonable price. When it comes to online document management, DocHub provides such a solution! Suppose you need to Change company in Mortgage Deed and manage paperwork efficiently and quickly. In that case, this is the suitable editor for you - accomplish your document-related tasks at any time and from any place in only a few minutes.

In addition to usability and straightforwardness, price is another great thing about DocHub. It has flexible and cost-effective subscription plans and enables you to test our service free of charge during a 30-day trial. Give it a try now!

this is dave at titlesearch.com in the world of deeds and mortgages and title searching a lot of times a document thats very frequently overlooked is the mortgage lien release remember that when a mortgage is placed on a property its a document thats signed by the borrower its a legal document its placed on the title it encumbers the title with a cloud until its released or when that mortgage is paid off that original mortgage document or lien doesnt get ripped out of the deed books it doesnt disappear doesnt get erased it stays in the same place it was originally recorded in the official legal land records but what happens is that document doesnt move another separate document which is the mortgage lien release has to be filed by the lender and that will go in a different place that will go in the deed book for that day when that release is filed it might be five or ten or fifteen years later after the original mortgage and in order to make that mortgage to not show up on a