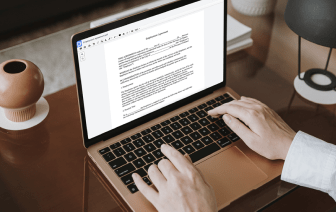

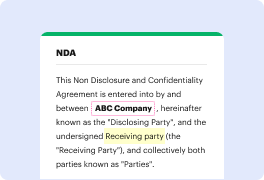

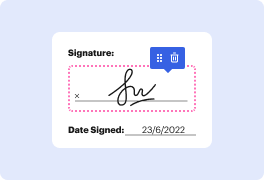

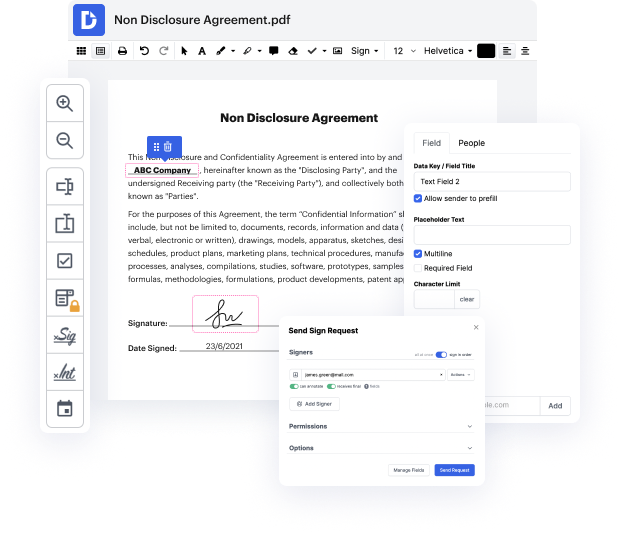

Document-centered workflows can consume plenty of your time, no matter if you do them regularly or only occasionally. It doesn’t have to be. In fact, it’s so easy to inject your workflows with additional productiveness and structure if you engage the right solution - DocHub. Sophisticated enough to handle any document-related task, our software lets you modify text, photos, comments, collaborate on documents with other parties, create fillable forms from scratch or web templates, and digitally sign them. We even protect your information with industry-leading security and data protection certifications.

You can access DocHub instruments from any place or device. Enjoy spending more time on creative and strategic work, and forget about cumbersome editing. Give DocHub a try right now and enjoy your Source Code License Agreement Template workflow transform!

Attorney Elizabeth Potts Weinstein discusses the process of closing or canceling your Employer Identification Number (EIN) with the IRS when shutting down a business. An EIN acts as a tax identification number for various business structures, including sole proprietorships, LLCs, and corporations. The attorney emphasizes the importance of closing the EIN to prevent future filings, payments, or taxes associated with a non-existent business. Additionally, canceling the EIN can help mitigate the risk of identity theft or fraud by reducing the number of open accounts. Properly managing this process is crucial for a thorough business shutdown.