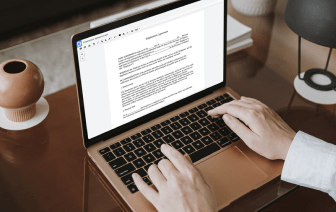

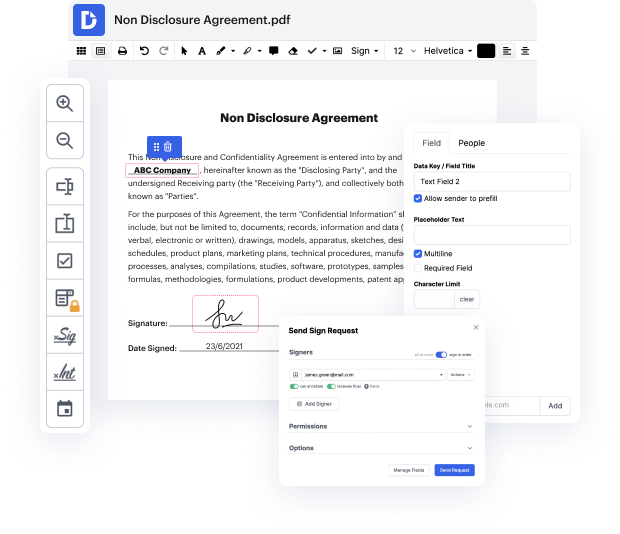

DocHub enables you to cancel ein in Product Sales Proposal Template quickly and quickly. Whether your form is PDF or any other format, you can effortlessly alter it using DocHub's easy-to-use interface and powerful editing capabilities. With online editing, you can change your Product Sales Proposal Template without downloading or setting up any software.

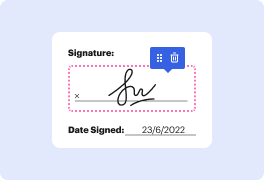

DocHub's drag and drop editor makes personalizing your Product Sales Proposal Template easy and efficient. We safely store all your edited papers in the cloud, letting you access them from anywhere, whenever you need. In addition, it's straightforward to share your papers with people who need to check them or create an eSignature. And our native integrations with Google products enable you to transfer, export and alter and sign papers right from Google apps, all within a single, user-friendly platform. Additionally, you can easily transform your edited Product Sales Proposal Template into a template for future use.

All processed papers are safely stored in your DocHub account, are effortlessly handled and moved to other folders.

DocHub simplifies the process of completing form workflows from day one!

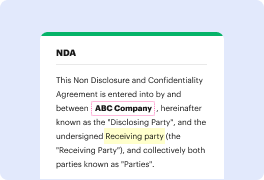

The sales proposal template is designed to standardize sales proposals. The first page allows customization with your logo. The second page features a table of contents that includes an executive summary, understanding, approach, pricing and terms, contact information, and an appendix. Throughout the proposal, you can input key information for each specific deal, which you can then present to the customer in hopes of winning the business.