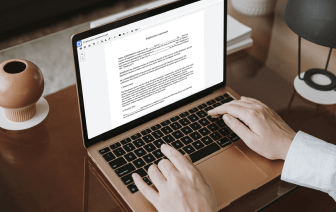

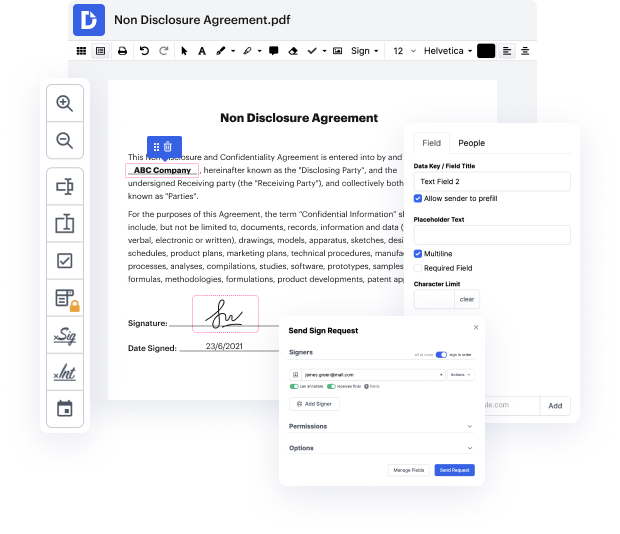

Whether you work with papers day-to-day or only from time to time need them, DocHub is here to help you take full advantage of your document-based tasks. This tool can cancel ein in Camper Health History, facilitate user collaboration and generate fillable forms and valid eSignatures. And even better, every record is kept safe with the highest safety standards.

With DocHub, you can get these features from any location and using any platform.

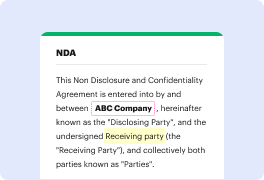

In this tutorial, attorney Elizabeth Potts Weinstein discusses the process of closing or canceling an Employer Identification Number (EIN) with the IRS when shutting down a business. She explains that an EIN, similar to a social security number for individuals, serves as a tax identification number for a business, whether it’s a sole proprietorship, LLC, or corporation. Closing the EIN is important to avoid future filings, payments, or taxes after the business ceases operations. Additionally, closing the EIN helps prevent potential fraud from open accounts that could be exploited after the business has shut down.