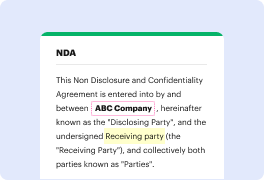

People often need to blot ein in UOML when managing documents. Unfortunately, few programs offer the features you need to complete this task. To do something like this usually requires switching between several software packages, which take time and effort. Luckily, there is a platform that suits almost any job: DocHub.

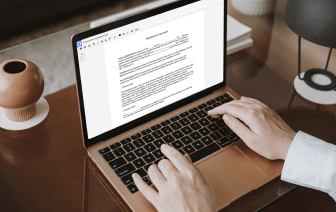

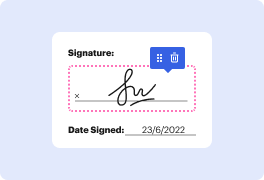

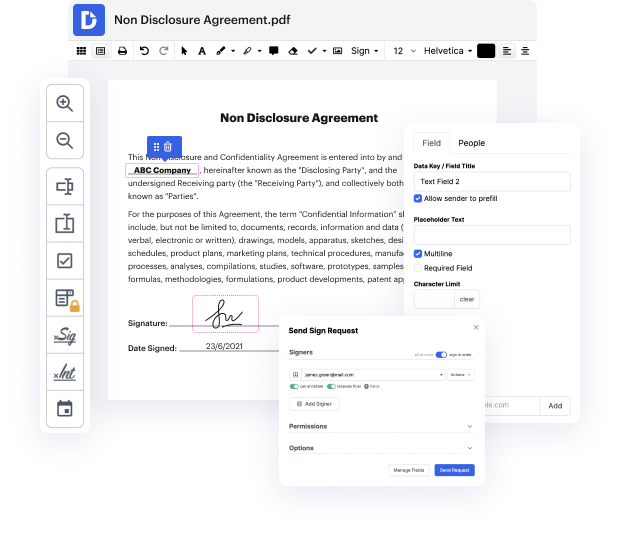

DocHub is a professionally-developed PDF editor with a complete set of helpful functions in one place. Editing, signing, and sharing paperwork is easy with our online tool, which you can access from any online device.

By following these five simple steps, you'll have your adjusted UOML rapidly. The user-friendly interface makes the process fast and effective - stopping switching between windows. Try DocHub now!

an employer identification number Ein is a unique identifier assigned to a business in order for it to be recognized by the Internal Revenue Service IRS itamp;#39;s made up of nine digits and is commonly used by employers for the purpose of tax reporting oh damn a business needs an EIN in order to hire and pay employees open bank accounts and file taxes just to name a few of the benefits so before starting your own business youamp;#39;re going to need