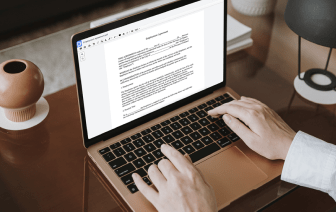

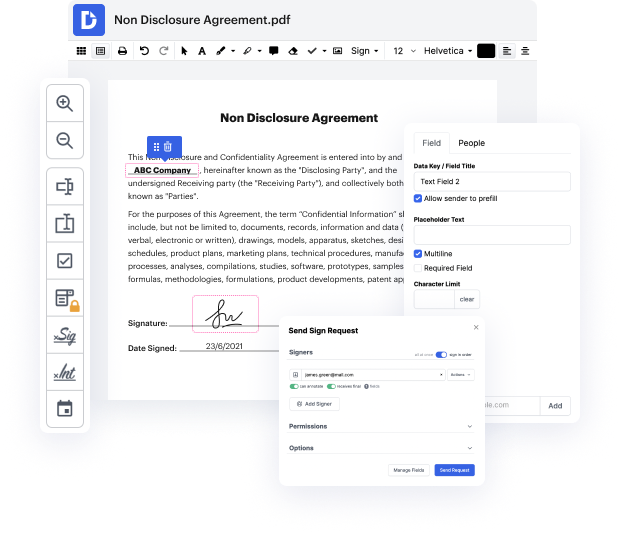

DocHub is an all-in-one PDF editor that lets you blot ein in UOF, and much more. You can highlight, blackout, or remove paperwork fragments, insert text and images where you need them, and collect information and signatures. And because it works on any web browser, you won’t need to update your hardware to access its professional tools, saving you money. With DocHub, a web browser is all it takes to manage your UOF.

Sign in to our website and follow these guidelines:

It couldn't be simpler! Enhance your document processing today with DocHub!

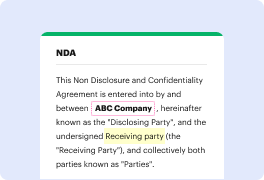

foreign identification number Ein is an essential unique identifier in filing taxes also known as business tax ID the nine digit number is integral in your day-to-day business operations so what happens if you have a lost Ein or simply forgot your EIN keep watching to find out more Ein confirmation letter the best place to look for the missing number is on the Ein confirmation letter that the IRS sent to you when you were issued your number to begin with now maybe thatamp;#39;s lost too but if you safely filed it when you received the letter it will contain the Ein along with other pertinent information about your business if you applied for Ein through the IRS website online then the IRS would have issued it right away you can probably still access the information online unless you opt to have it sent via mail if you applied for your number via fax they would likely have sent a return fax to you if you can locate the original letter the IRS typically prints the number in the upper ri