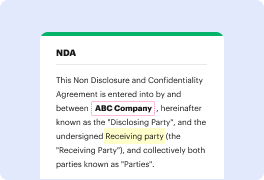

Security should be the primary consideration when looking for a document editor on the web. There’s no need to spend time browsing for a reliable yet cost-effective service with enough functionality to Bind type in Plan of Dissolution. DocHub is just the one you need!

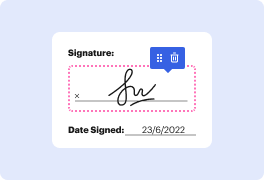

Our solution takes user privacy and data protection into account. It complies with industry standards, like GDPR, CCPA, and PCI DSS, and continuously improves its compliance to become even more risk-free for your sensitive information. DocHub allows you to set up dual-factor authentication for your account configurations (via email, Authenticator App, or Backup codes).

Therefore, you can manage any paperwork, including the Plan of Dissolution, risk-free and without hassles.

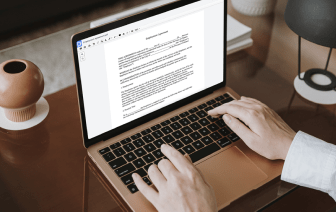

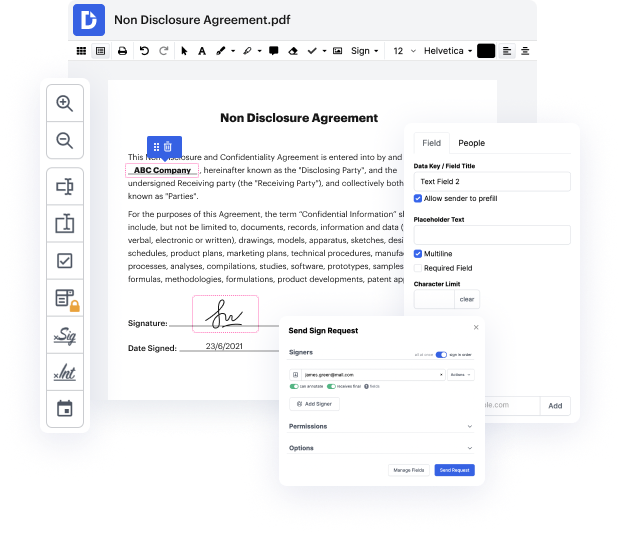

In addition to being reliable, our editor is also really straightforward to use. Follow the instruction below and make sure that managing Plan of Dissolution with our tool will take only a few clicks.

If you often manage your paperwork in Google Docs or need to sign attachments you’ve got in Gmail quickly, DocHub is also a good option to choose, as it perfectly integrates with Google services. Make a one-click form upload to our editor and complete tasks in a few minutes instead of continuously downloading and re-uploading your document for processing. Try DocHub right now!

hey there youtube so in this video i wanted to cover the irs form 966 this is the form for corporate dissolutions or liquidations so if you have a us corporation so this is a lets say a regular corporation for-profit corporation informed under state law or if you have an llc that filed an election to be taxed as a c-corp if you close down that entity you will need to file this form 966 within 30 days after you adopt a plan or resolution to close down the company so i want to run through the form the various elements and the things you need to include with it just to make sure youre doing this as correctly as possible so the top of the form is relatively straightforward right we have the name of the corporation uh here obviously ive got a company delaware company inc not a real business so dont use this uh the mailing address for the company the ein for the company and the type of return were filing right so this is a standard c corp return so 1120 if you have an s corporation th