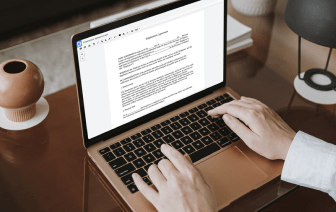

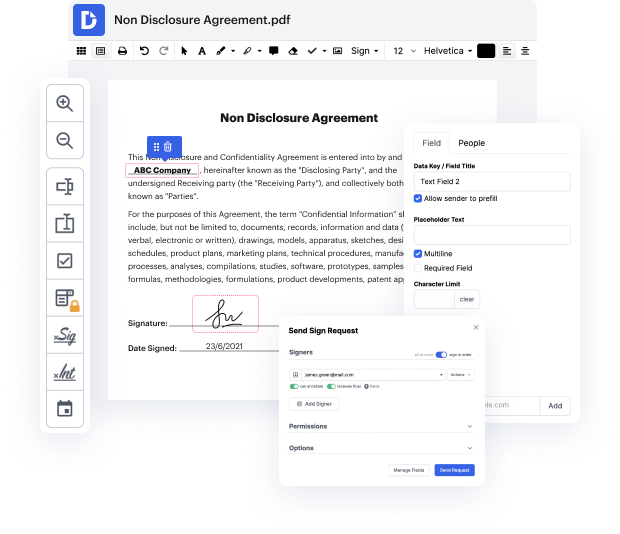

DocHub enables you to add picture in Deferred Compensation Plan easily and quickly. Whether your form is PDF or any other format, you can easily alter it utilizing DocHub's intuitive interface and powerful editing tools. With online editing, you can alter your Deferred Compensation Plan without downloading or setting up any software.

DocHub's drag and drop editor makes personalizing your Deferred Compensation Plan straightforward and streamlined. We safely store all your edited papers in the cloud, letting you access them from anywhere, whenever you need. Moreover, it's effortless to share your papers with users who need to review them or create an eSignature. And our deep integrations with Google products allow you to transfer, export and alter and sign papers directly from Google apps, all within a single, user-friendly platform. Plus, you can effortlessly convert your edited Deferred Compensation Plan into a template for recurring use.

All executed papers are safely saved in your DocHub account, are effortlessly managed and moved to other folders.

DocHub simplifies the process of certifying form workflows from day one!

Deferred compensation is a benefit available to many corporate executives, explained by Michelle Smallenberger from Financial Design Studio. The tutorial discusses key aspects such as what deferred compensation is, optimal timing for its use, tax implications, and the decisions associated with it. Essentially, deferred compensation allows individuals to defer income to a future date, often to achieve tax savings by shifting income to a time when they may be in a lower tax bracket. The discussion also includes the pros and cons of this benefit and its impact on financial planning.