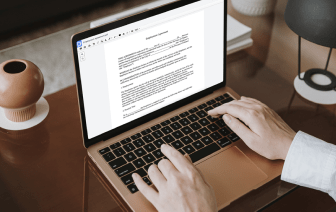

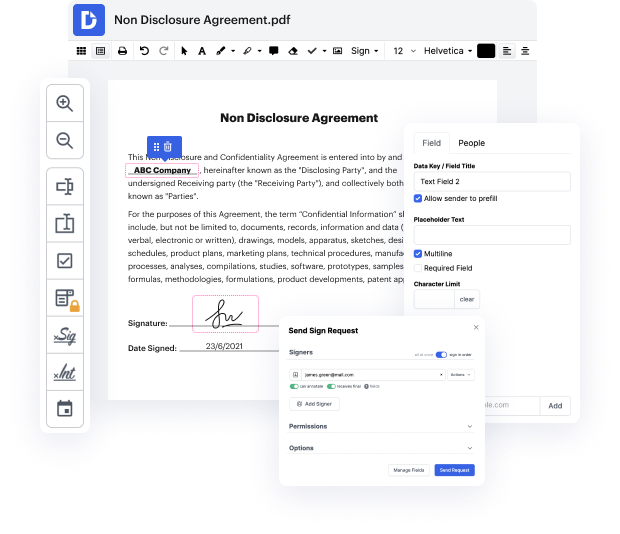

Are you searching for a quick and easy way to add line in Deferred Compensation Plan? Your search is over - DocHub gets the job done fast, with no complicated software. You can use it on your mobile phone and computer, or browser to modify Deferred Compensation Plan anytime and anywhere. Our comprehensive software package contains everything from basic and advanced editing to annotating and includes safety measures for individuals and small companies. We also provide tutorials and guides that help you get your business up and running right away. Working with DocHub is as simple as this.

Easy, right? Better still, you don't need to be concerned about data protection. DocHub provides quite a number of features that help you keep your sensitive data risk-free – encrypted folders, two-factor authorization, and more. Enjoy the bliss of reaching your document management goals with our professional and industry-compliant solution, and kiss inefficiency goodbye. Give DocHub a try today!

- What is a 457 or a deferred comp? Were getting into it in this video. (upbeat music) A 457 is very similar to a 401(k), but its for state or government employees. And we talked about 403bs. You can actually look at the video up here if youre interested in that. And the unique thing about school boards is theyre state employees, but they can also have 403bs and 457. So sometimes youll see both. But if youre not in the school board, you probably just have a 457 available to you. What a 457 is, is its basically a government 401(k), but theres a few different distinctions. First of all, if youre still working with a 403(b) or a 401(k), you can actually get access to your money at age 59 and a half without a tax folio. If youre still working at 457, you have to wait until age 70 to get access to your money. But for those of you retiring early this is really important because we have a lot of firefighters and police officers and other government employees that can retire early yo