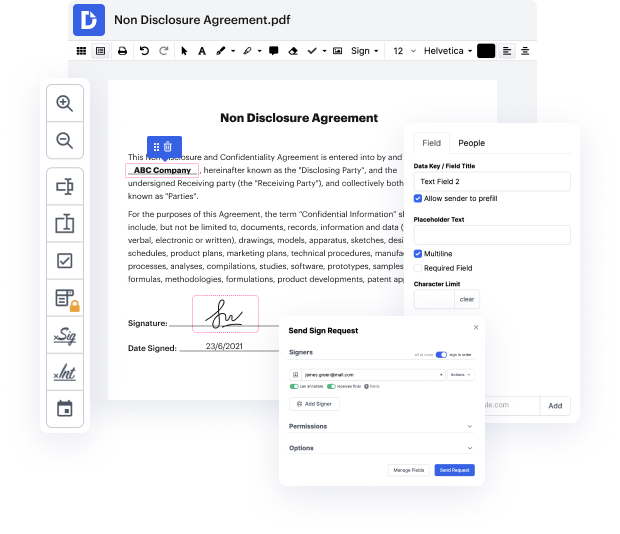

Security should be the primary consideration when searching for a document editor on the web. There’s no need to waste time browsing for a trustworthy yet inexpensive tool with enough features to Add image in Hardship Letter. DocHub is just the one you need!

Our tool takes user privacy and data safety into account. It complies with industry standards, like GDPR, CCPA, and PCI DSS, and constantly extends compliance to become even more hazard-free for your sensitive data. DocHub allows you to set up dual-factor authentication for your account settings (via email, Authenticator App, or Backup codes).

Hence, you can manage any documentation, including the Hardship Letter, risk-free and without hassles.

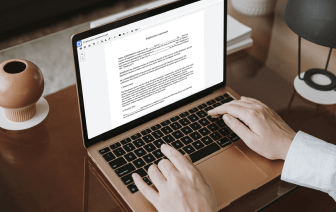

Apart from being trustworthy, our editor is also extremely simple to use. Adhere to the guideline below and ensure that managing Hardship Letter with our service will take only a few clicks.

If you often manage your paperwork in Google Docs or need to sign attachments you’ve got in Gmail quickly, DocHub is also a good choice, as it flawlessly integrates with Google services. Make a one-click form upload to our editor and accomplish tasks in a few minutes instead of continuously downloading and re-uploading your document for processing. Try out DocHub today!

[Music] hello guys today we are going to talk a little bit about your hardship letter so when youre applying for a loan modification you really want to think about what the purpose behind your hardship letter is as opposed to if you are applying for either a deed in lieu or a short sale the purpose is kind of different so generally understanding what youre trying to convey with your hardship letter is important when youre applying for a loan modification or a repayment plan or something to keep the home youre trying to let the bank know that while you underwent financial hardship you since then have recovered youre in a good financial position now if youre applying for something to get out of your debt like a short sale or a deed in lieu or something where youre trying to get the lender to agree to just let you out you want to make your financial hardship sound like you have not recovered at all and that the mortgage payments are very unaffordable so before you actually sit down