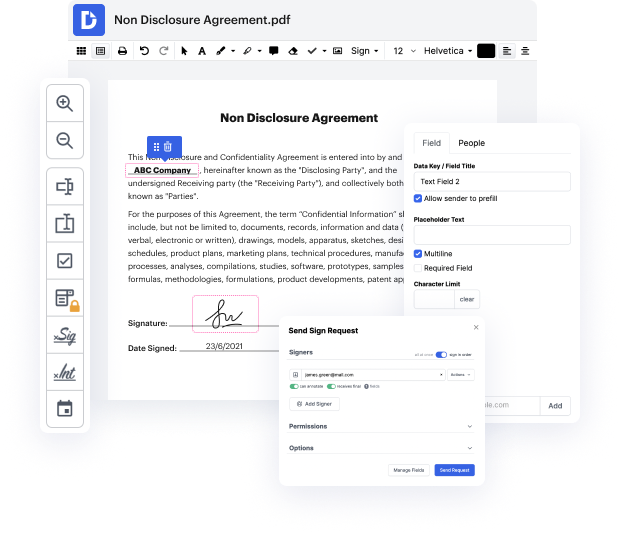

Managing business documentation can be burdensome and time-consuming, even with comprehensive but old-fashioned operating editors. However, tools empowered with Artificial Intelligence functions can make your work several times easier. Try out DocHub to Add fillable fields to Invoice with AI in Nonprofit Organizations industry and find your forms properly modified in just minutes.

New technologies give more advanced possibilities for individuals and SMBs in different areas, including Nonprofit Organizations industry. Benefit from AI-driven editing capabilities provided by DocHub and complete your document management tasks quickly and efficiently. Get started now!