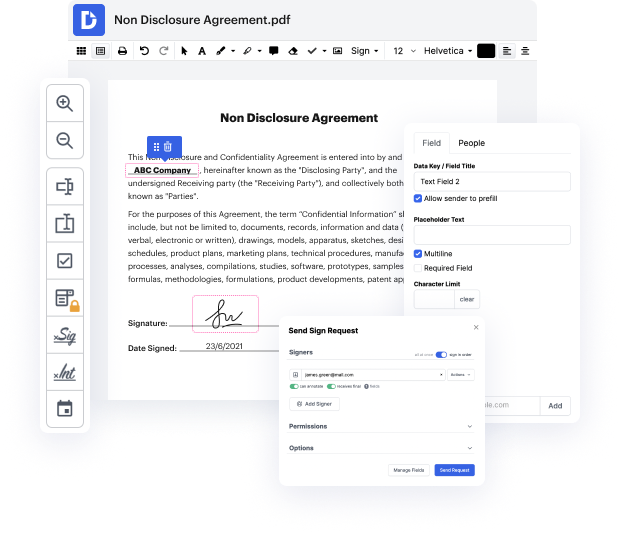

Do you want to prevent the difficulties of editing Plan of Dissolution on the web? You don’t have to worry about downloading unreliable services or compromising your paperwork ever again. With DocHub, you can add background in Plan of Dissolution without spending hours on it. And that’s not all; our easy-to-use solution also provides you with robust data collection tools for gathering signatures, information, and payments through fillable forms. You can build teams using our collaboration capabilities and effectively work together with multiple people on documents. Additionally, DocHub keeps your data secure and in compliance with industry-leading safety standards.

DocHub enables you to access its tools regardless of your device. You can use it from your notebook, mobile phone, or tablet and edit Plan of Dissolution effortlessly. Begin working smarter right now with DocHub!

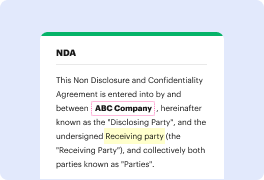

In this video, the tutorial focuses on IRS Form 966, which is necessary for corporate dissolutions or liquidations. If you have a U.S. corporation or an LLC taxed as a C-corp and plan to close the entity, you must file Form 966 within 30 days of adopting a closure resolution. The presenter explains the form's components, including the corporation’s name, mailing address, EIN, and the type of return being filed (standard C-corp return 1120). He emphasizes the importance of correctly completing the form and accompanying it with the necessary documents to ensure compliance.