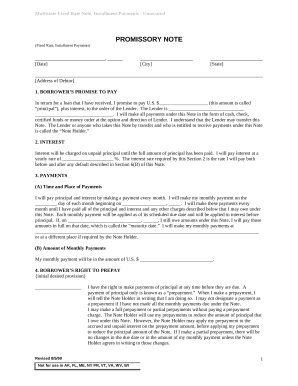

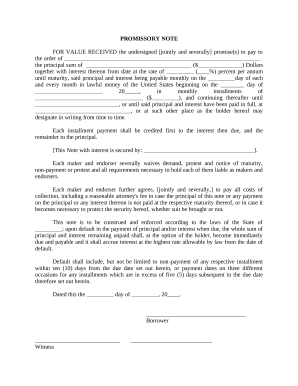

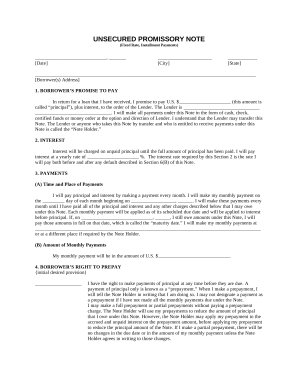

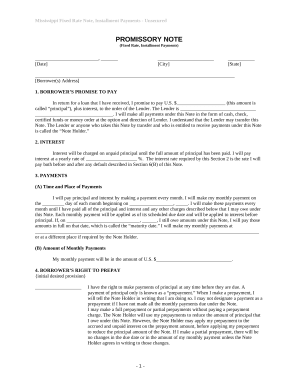

Speed up your file managing using our Unsecured Loan Agreements online library with ready-made form templates that suit your needs. Get your form template, modify it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently together with your forms.

The best way to use our Unsecured Loan Agreements:

Examine all the opportunities for your online document management using our Unsecured Loan Agreements. Get your totally free DocHub profile right now!