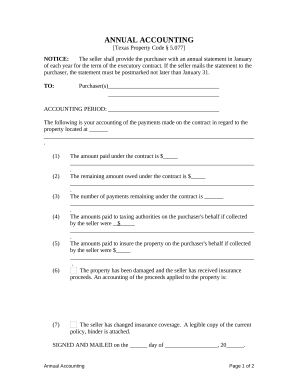

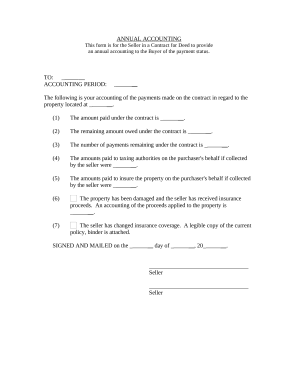

Speed up your form managing using our Seller's Annual Accounting Statement Forms library with ready-made form templates that suit your needs. Get your form template, alter it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently with the documents.

The best way to use our Seller's Annual Accounting Statement Forms:

Examine all of the possibilities for your online document management with the Seller's Annual Accounting Statement Forms. Get a totally free DocHub account today!