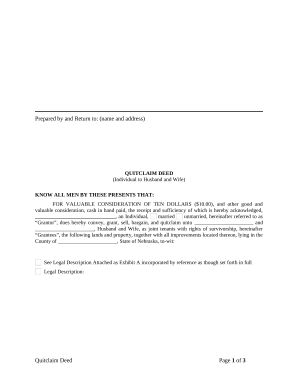

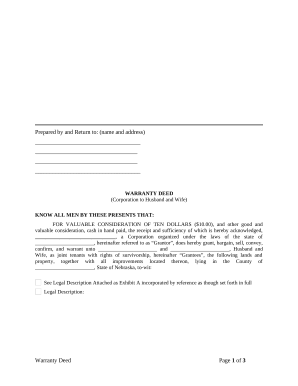

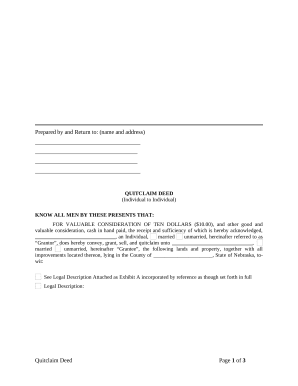

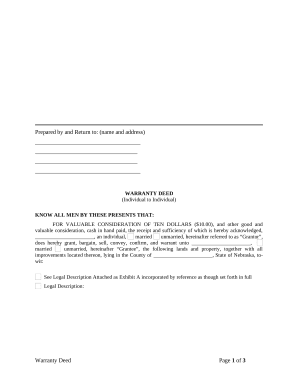

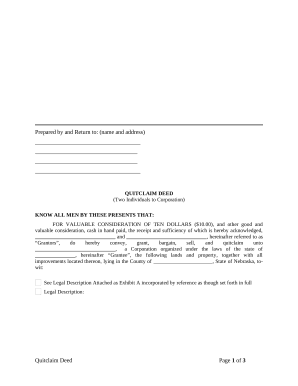

Your workflows always benefit when you can obtain all the forms and documents you will need on hand. DocHub delivers a a huge library of form templates to alleviate your daily pains. Get hold of Nebraska Property Transfer category and easily discover your form.

Begin working with Nebraska Property Transfer in several clicks:

Enjoy fast and easy record managing with DocHub. Check out our Nebraska Property Transfer category and look for your form right now!