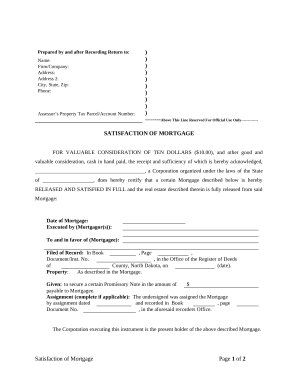

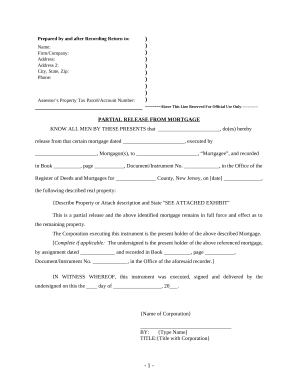

Your workflows always benefit when you can easily discover all of the forms and files you will need on hand. DocHub delivers a a huge library of templates to alleviate your day-to-day pains. Get hold of Legal Forms for Deeds of Trust category and easily discover your form.

Start working with Legal Forms for Deeds of Trust in a few clicks:

Enjoy easy record managing with DocHub. Discover our Legal Forms for Deeds of Trust category and get your form right now!