First, sign in to your DocHub account. If you don't have one, you can simply register for free.

Once you’re in, navigate to your dashboard. This is your main hub for all document-focused processes.

In your dashboard, choose New Document in the upper left corner. Hit Create Blank Document to put together the Independent Contractors Form from a blank slate.

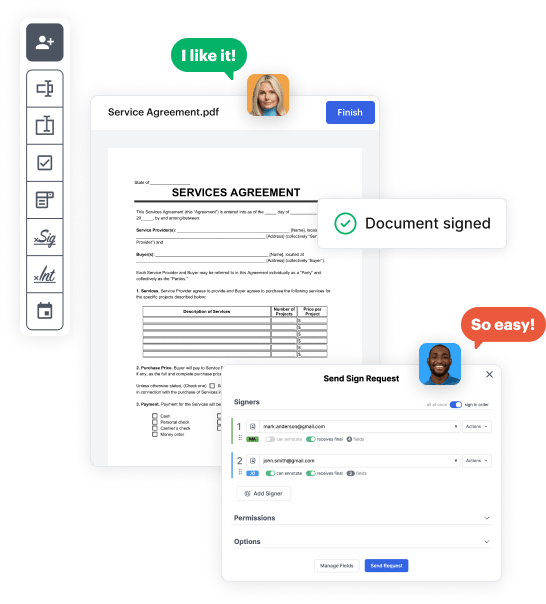

Add numerous fields like text boxes, images, signature fields, and other interactive areas to your form and designate these fields to particular users as needed.

Personalize your template by including directions or any other necessary tips utilizing the text option.

Attentively go over your created Independent Contractors Form for any mistakes or required adjustments. Utilize DocHub's editing capabilities to perfect your document.

After finalizing, save your file. You can select to save it within DocHub, export it to various storage solutions, or forward it via a link or email.